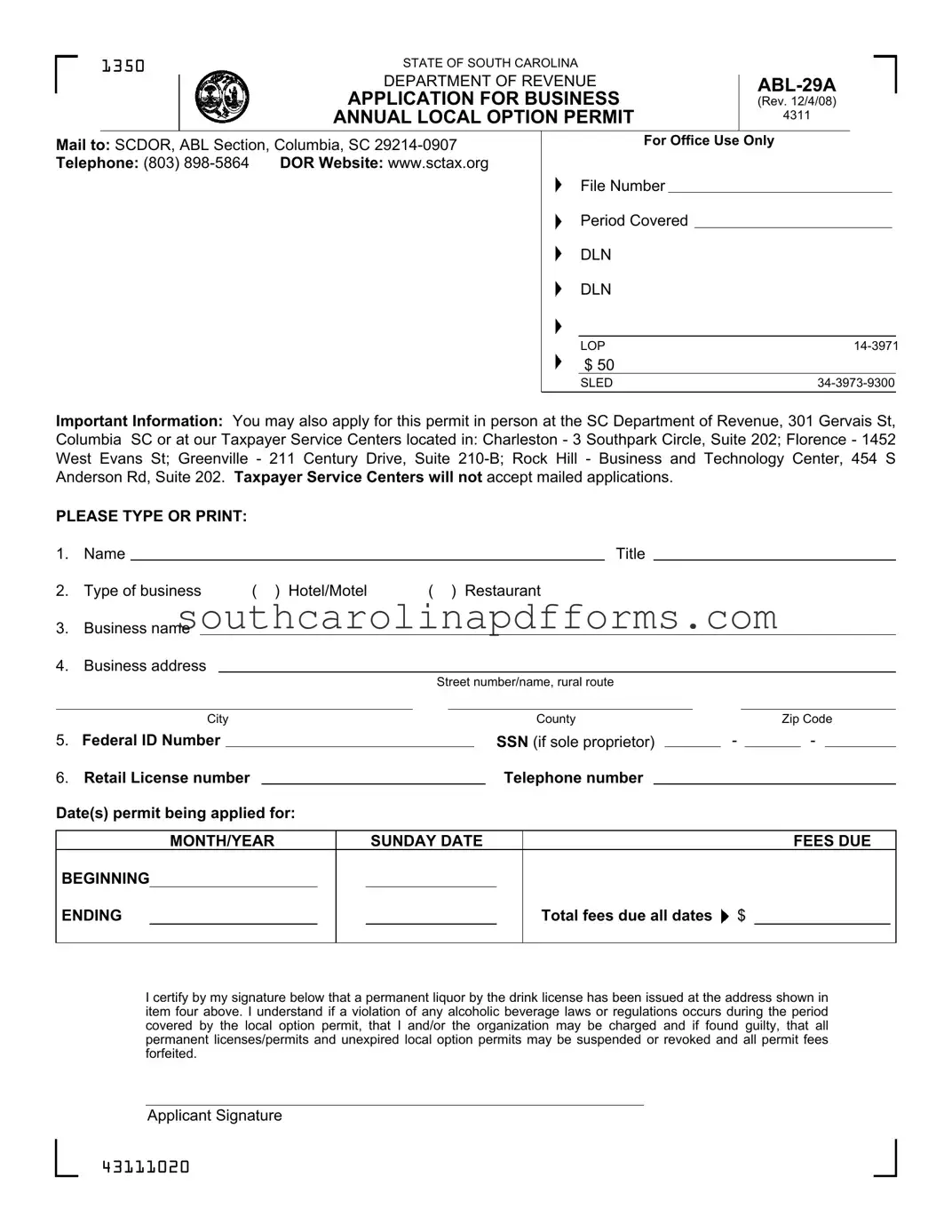

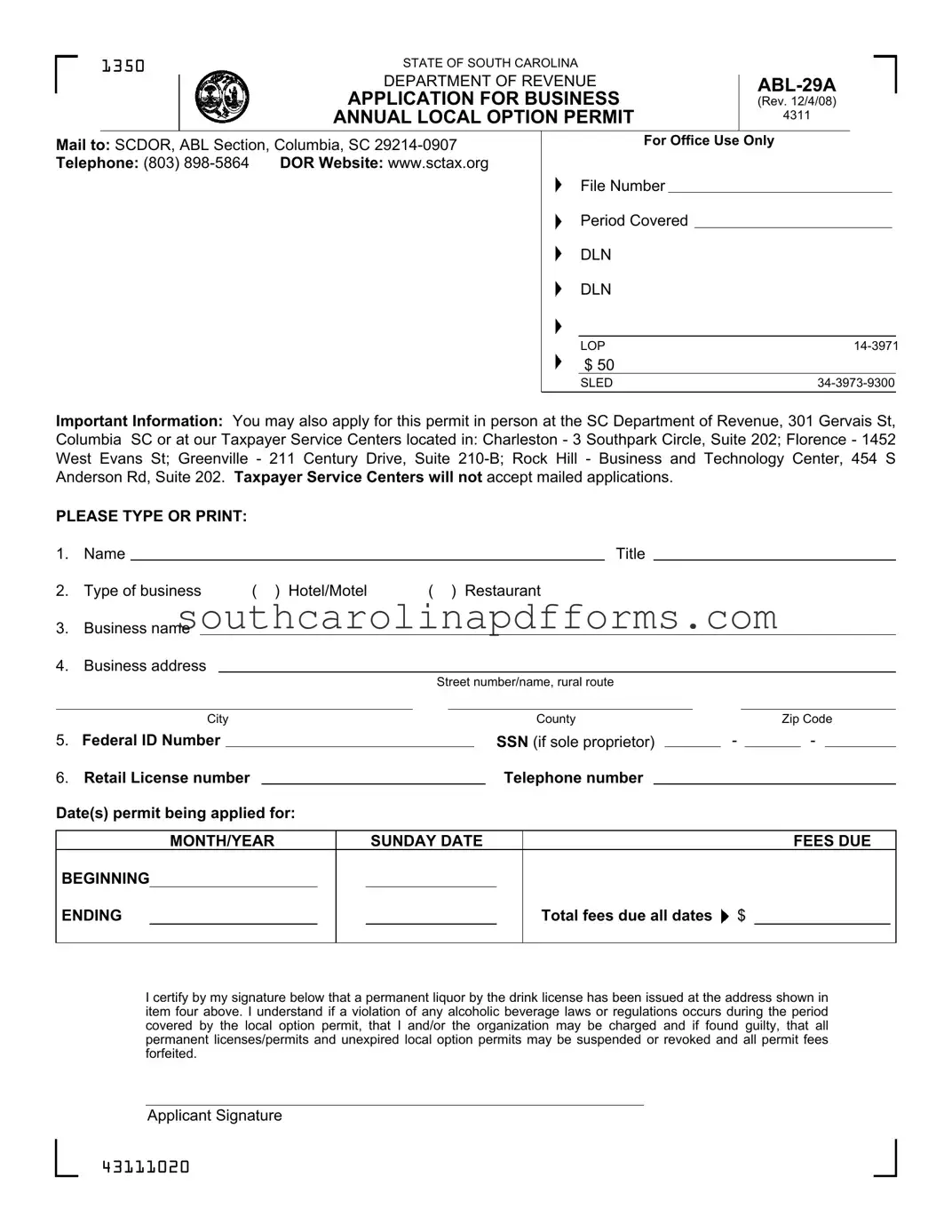

Abl 29A Template

The Abl 29A form is an application for the Business Annual Local Option Permit in South Carolina. This permit allows food establishments with a permanent liquor by the drink license to operate and serve alcoholic beverages during restricted hours. Understanding the requirements and process for this form is essential for compliance and successful application.

Access Abl 29A Here

Abl 29A Template

Access Abl 29A Here

Finish the form and move forward

Edit, save, and finish Abl 29A online.

Access Abl 29A Here

or

▼ PDF Form