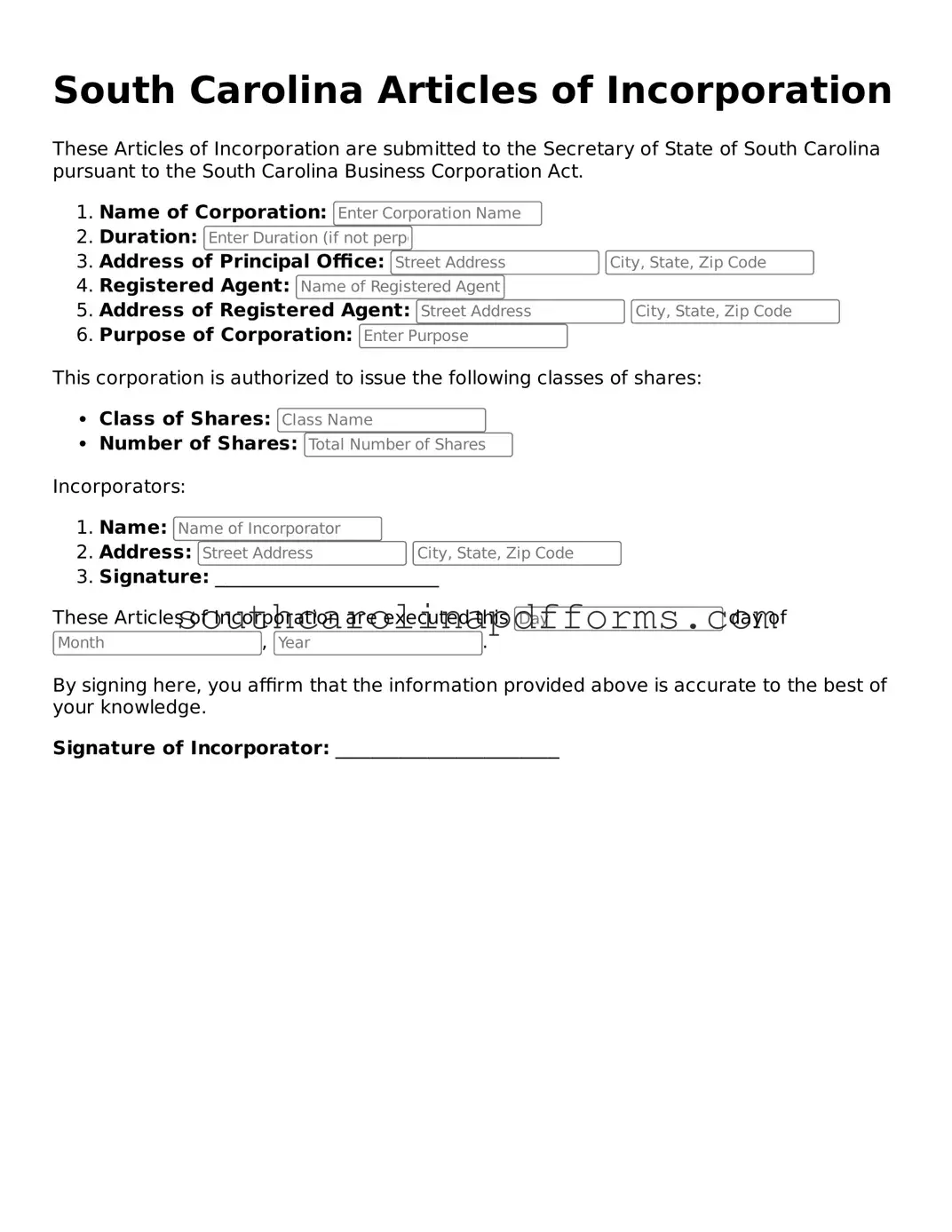

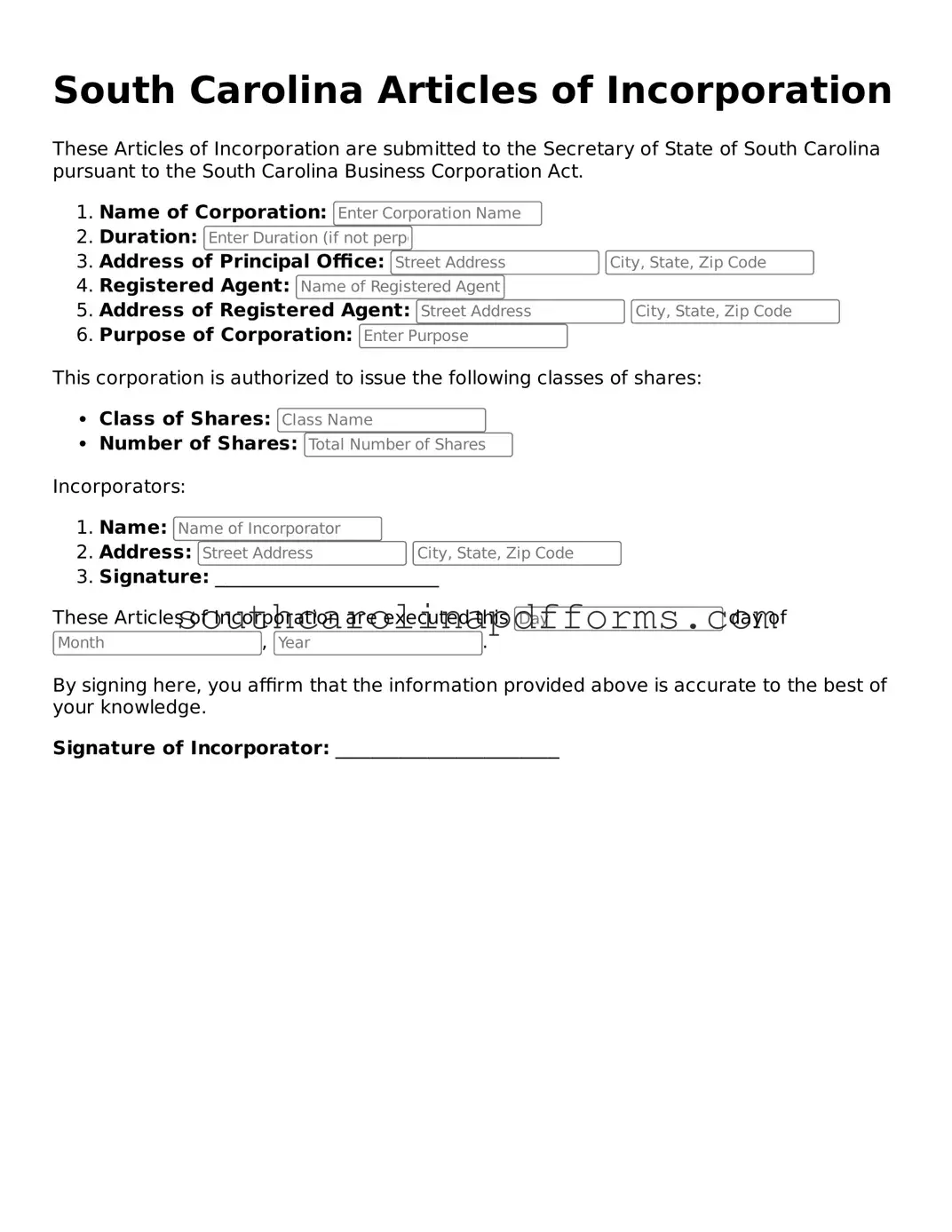

Attorney-Approved South Carolina Articles of Incorporation Document

The South Carolina Articles of Incorporation form is a crucial document that establishes a corporation in the state. This form outlines essential details about the business, including its name, purpose, and structure. Completing this form is the first step toward legally forming a corporation and enjoying the benefits that come with it.

Access Articles of Incorporation Here

Attorney-Approved South Carolina Articles of Incorporation Document

Access Articles of Incorporation Here

Finish the form and move forward

Edit, save, and finish Articles of Incorporation online.

Access Articles of Incorporation Here

or

▼ PDF Form