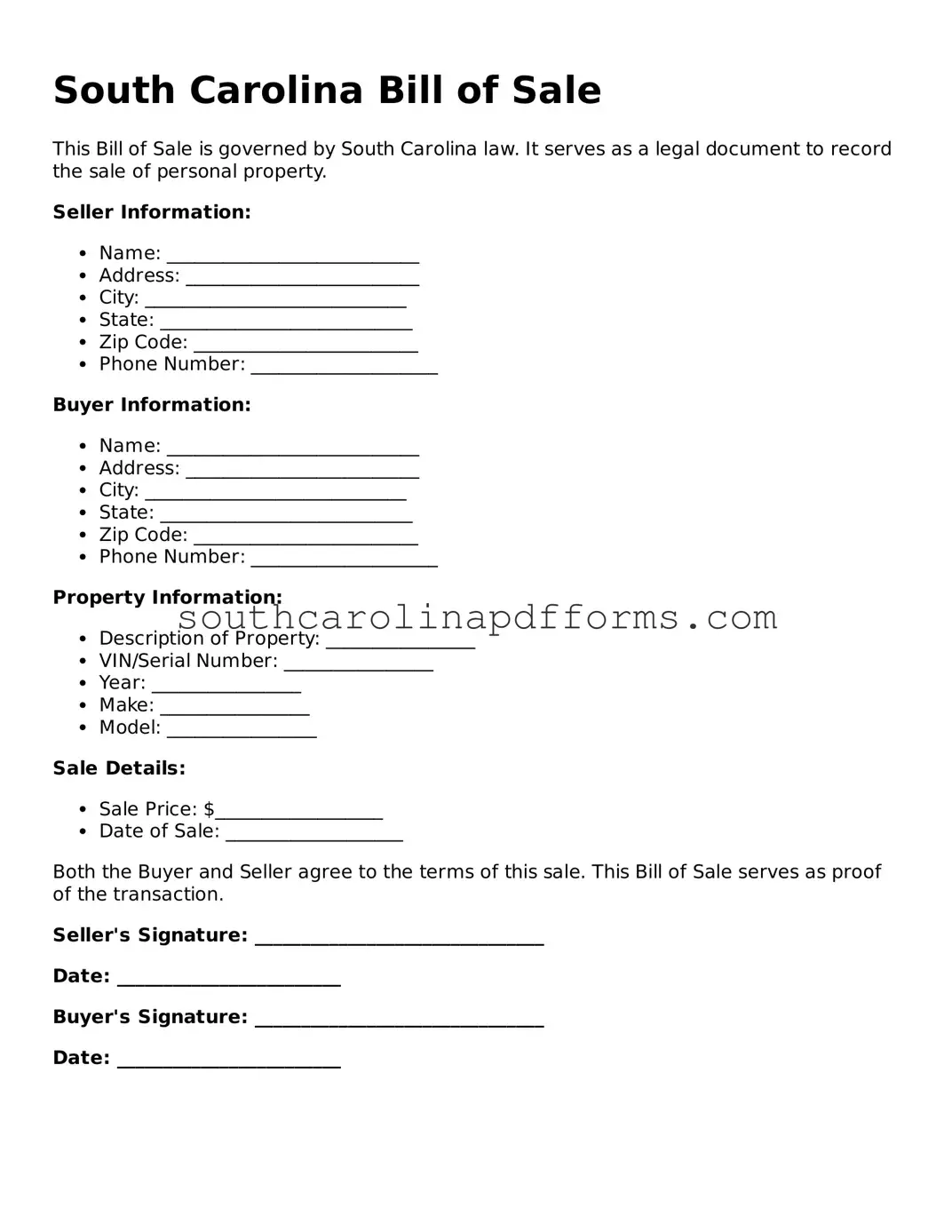

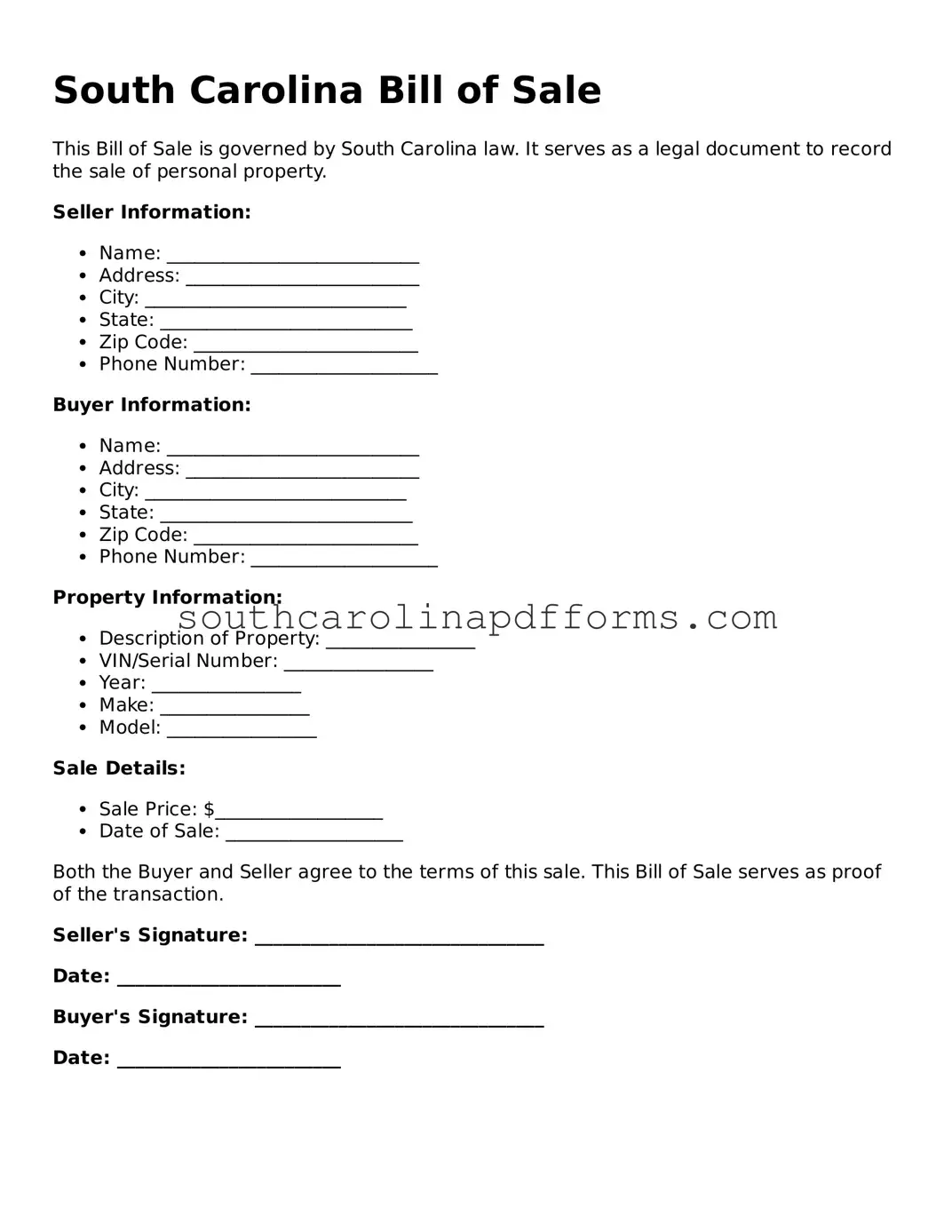

Attorney-Approved South Carolina Bill of Sale Document

A South Carolina Bill of Sale form is a legal document that serves as proof of the transfer of ownership of personal property from one party to another. This form is essential for both buyers and sellers, providing a clear record of the transaction. Understanding its components and requirements can help ensure a smooth transfer process.

Access Bill of Sale Here

Attorney-Approved South Carolina Bill of Sale Document

Access Bill of Sale Here

Finish the form and move forward

Edit, save, and finish Bill of Sale online.

Access Bill of Sale Here

or

▼ PDF Form