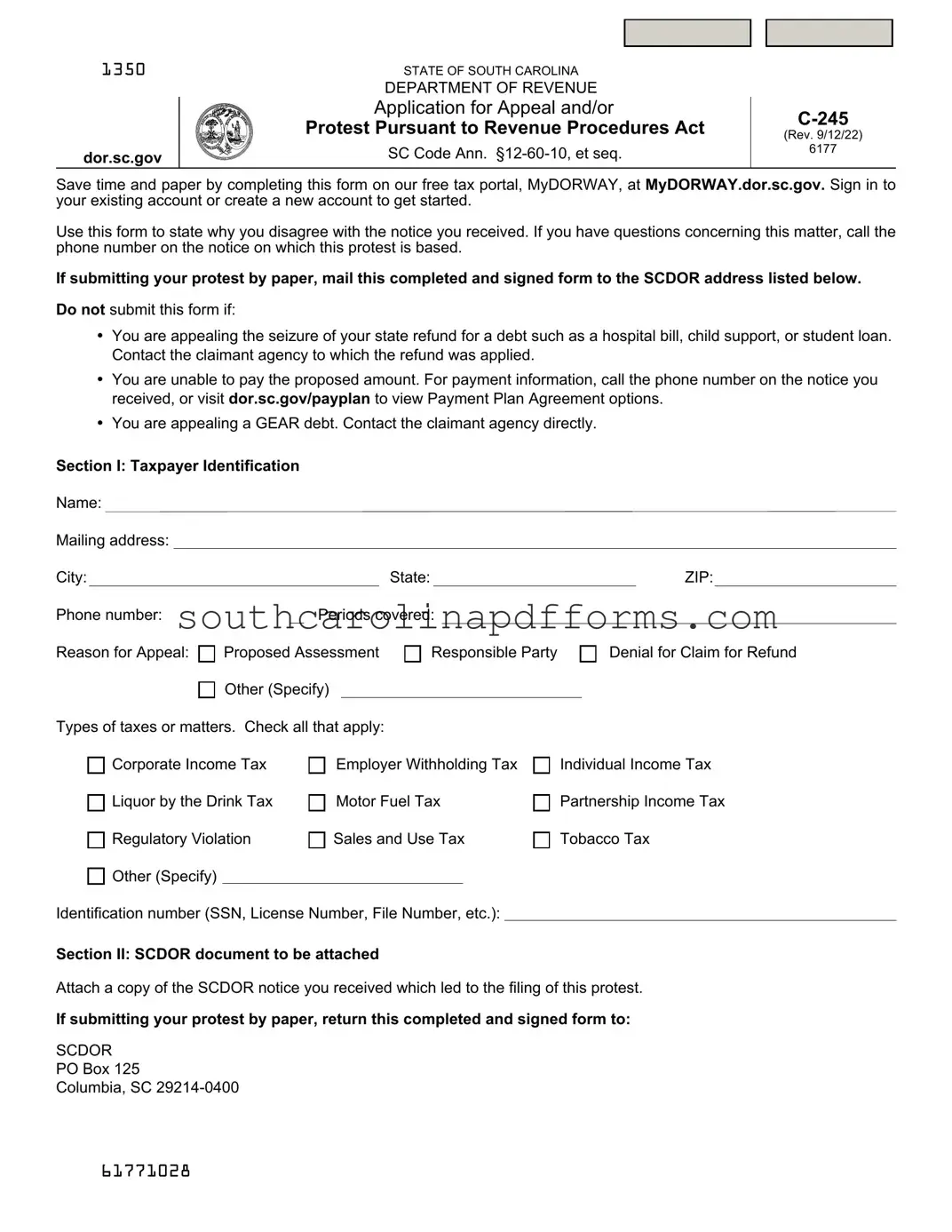

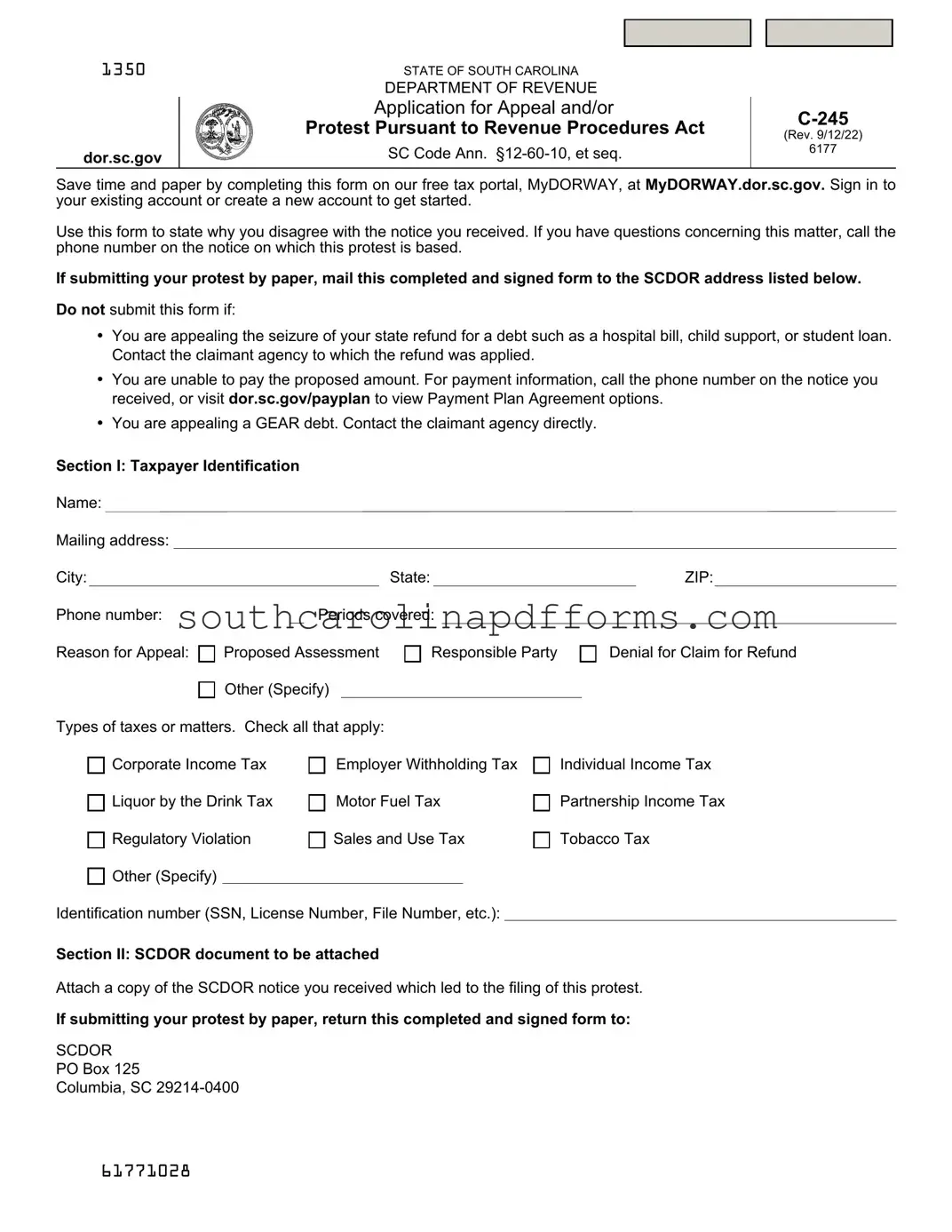

C 245 Carolina Template

The C 245 Carolina form is an official document used in South Carolina for individuals or entities wishing to appeal or protest a notice from the Department of Revenue. This form allows taxpayers to articulate their disagreements with the findings of the notice they received. By completing this form, taxpayers can formally submit their reasons for the appeal and provide supporting documentation as needed.

Access C 245 Carolina Here

C 245 Carolina Template

Access C 245 Carolina Here

Finish the form and move forward

Edit, save, and finish C 245 Carolina online.

Access C 245 Carolina Here

or

▼ PDF Form