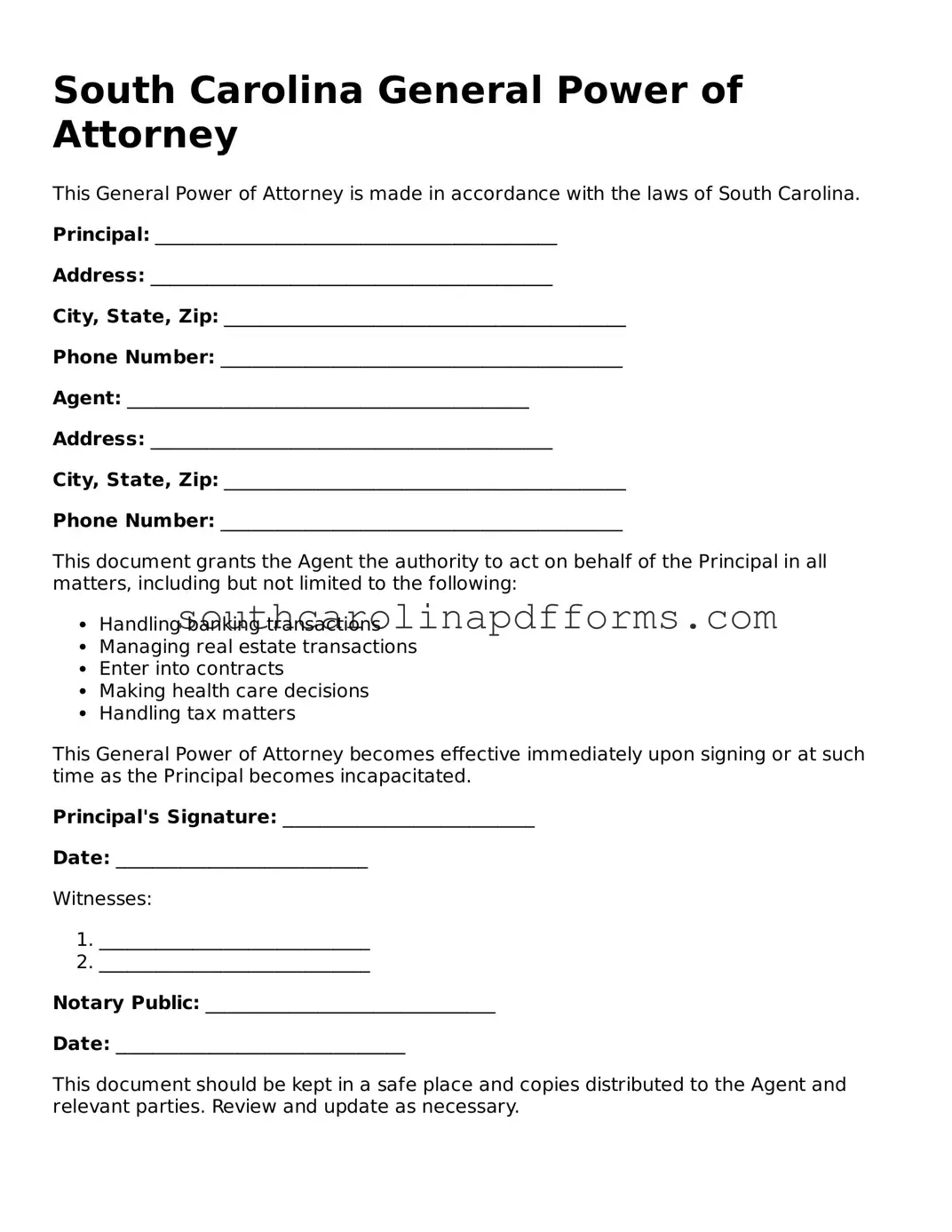

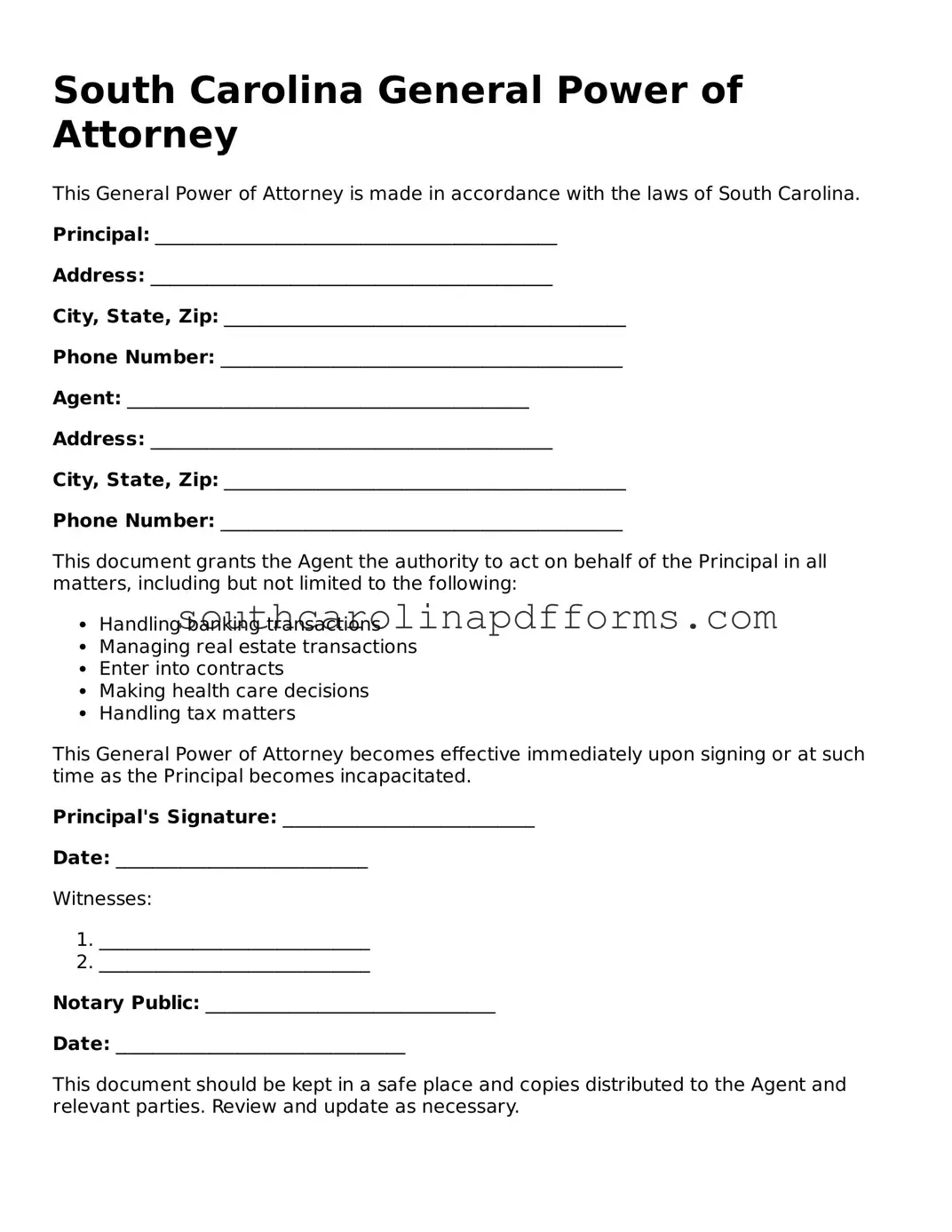

Attorney-Approved South Carolina General Power of Attorney Document

A South Carolina General Power of Attorney form is a legal document that allows one person, known as the principal, to grant another person, called the agent, the authority to act on their behalf in various financial and legal matters. This form is essential for individuals who want to ensure their affairs are managed according to their wishes, especially in situations where they may become incapacitated or unavailable. By using this form, principals can maintain control over their decisions while entrusting their agent to handle specific responsibilities.

Access General Power of Attorney Here

Attorney-Approved South Carolina General Power of Attorney Document

Access General Power of Attorney Here

Finish the form and move forward

Edit, save, and finish General Power of Attorney online.

Access General Power of Attorney Here

or

▼ PDF Form