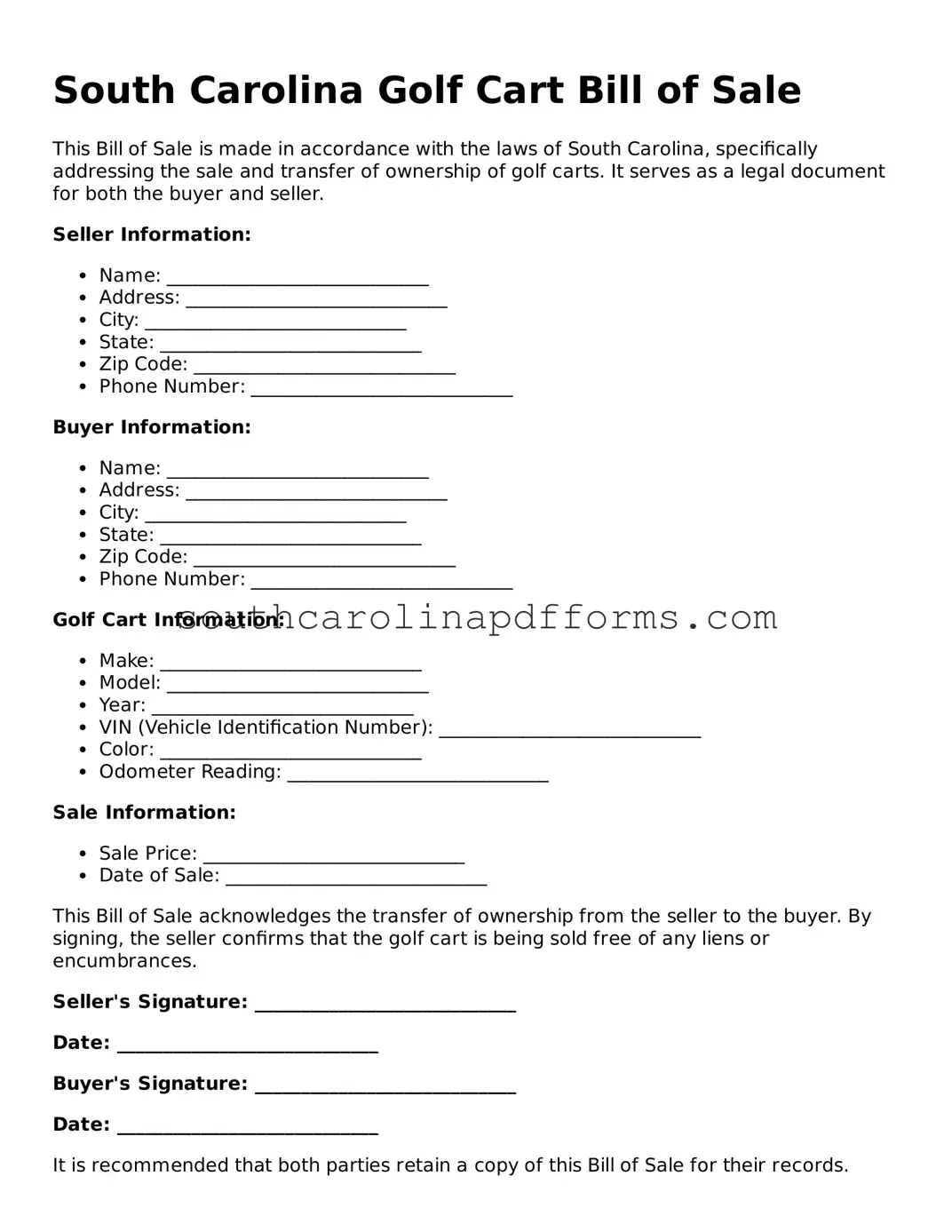

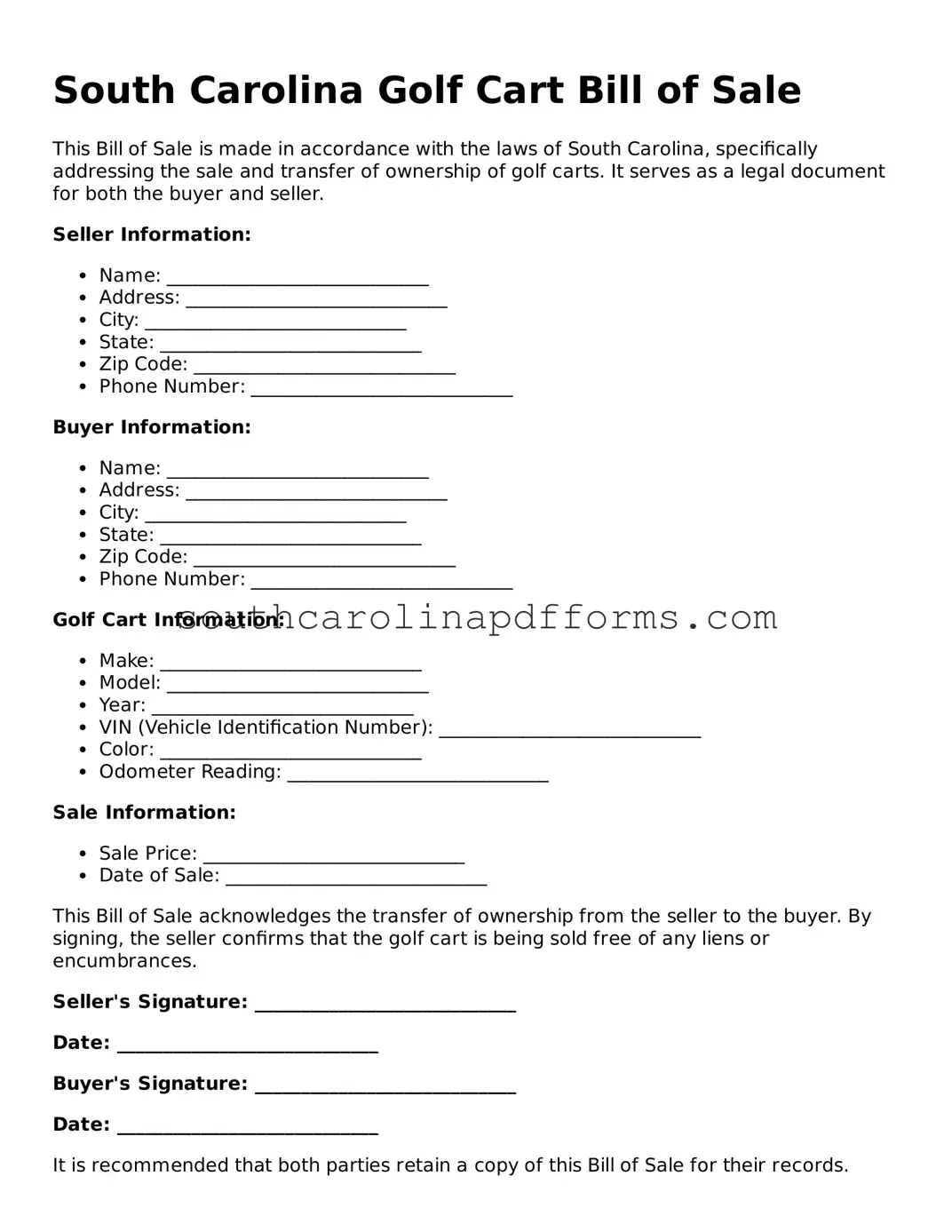

Attorney-Approved South Carolina Golf Cart Bill of Sale Document

A South Carolina Golf Cart Bill of Sale is a legal document that records the transfer of ownership of a golf cart from one party to another. This form not only protects the buyer and seller but also ensures that the transaction is documented for future reference. Understanding its components and importance can help make the buying or selling process smoother and more secure.

Access Golf Cart Bill of Sale Here

Attorney-Approved South Carolina Golf Cart Bill of Sale Document

Access Golf Cart Bill of Sale Here

Finish the form and move forward

Edit, save, and finish Golf Cart Bill of Sale online.

Access Golf Cart Bill of Sale Here

or

▼ PDF Form