Attorney-Approved South Carolina Power of Attorney Document

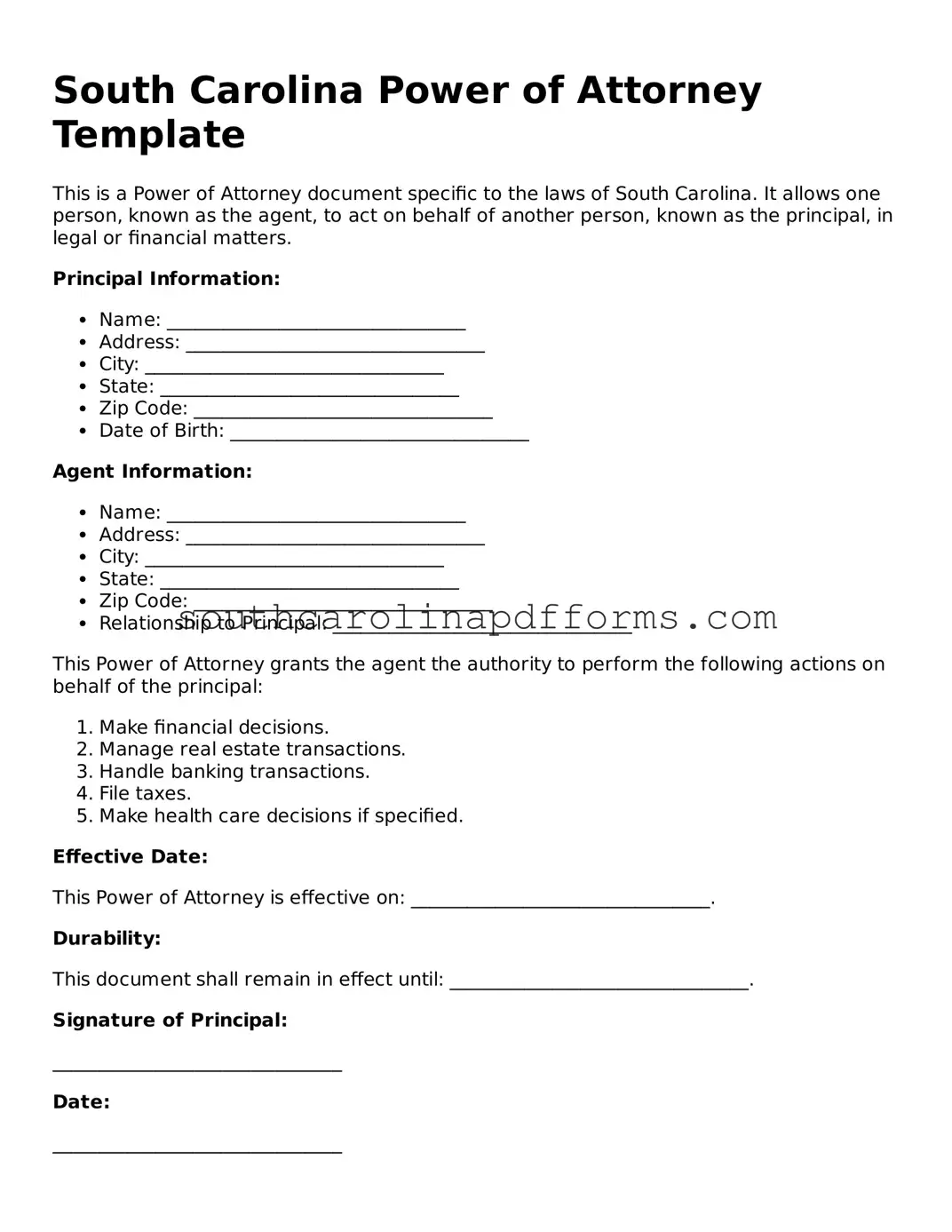

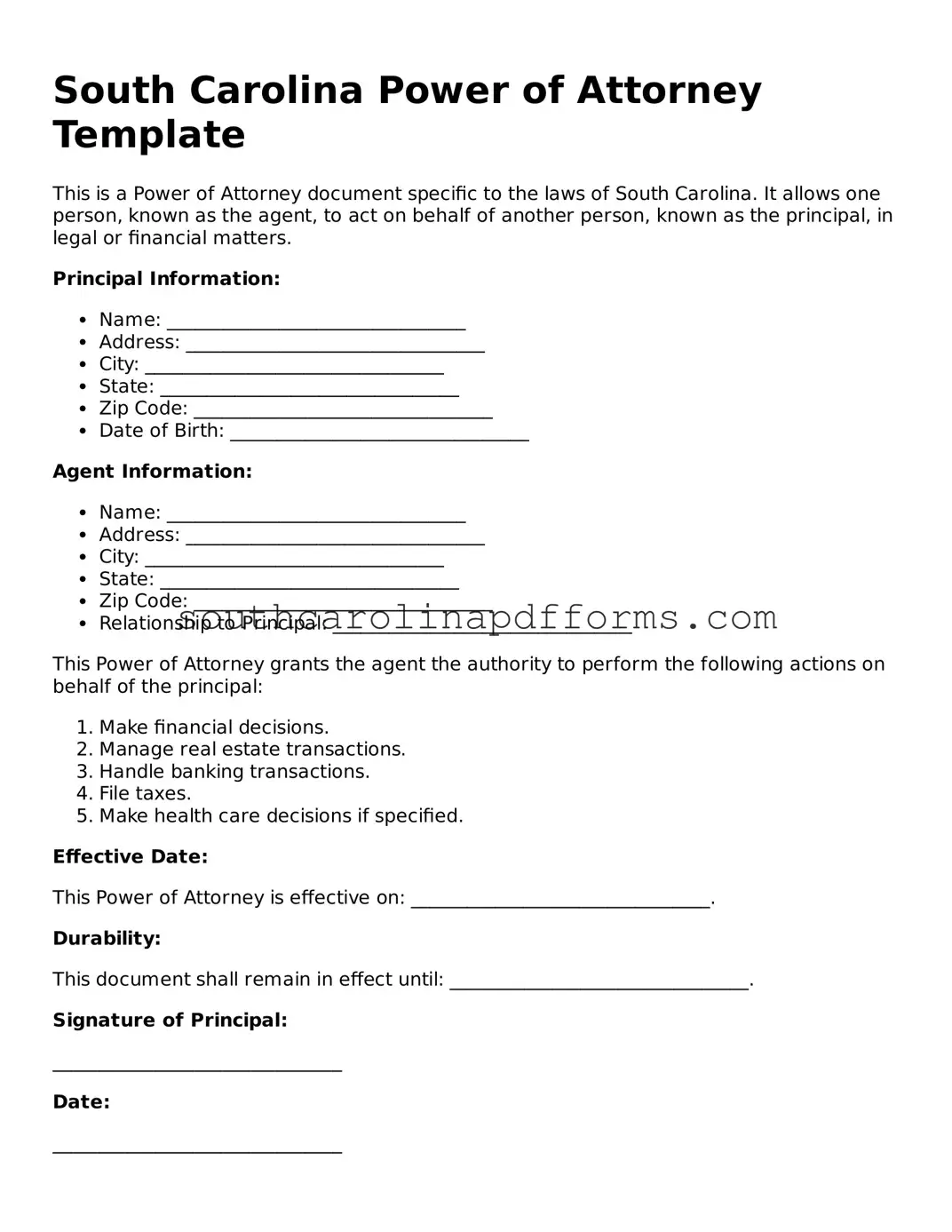

A Power of Attorney form in South Carolina allows an individual, known as the principal, to appoint someone else, called an agent, to make decisions on their behalf. This legal document can cover various areas, including financial matters and healthcare decisions. Understanding how to properly use this form is crucial for ensuring that your wishes are respected when you are unable to act for yourself.

Access Power of Attorney Here

Attorney-Approved South Carolina Power of Attorney Document

Access Power of Attorney Here

Finish the form and move forward

Edit, save, and finish Power of Attorney online.

Access Power of Attorney Here

or

▼ PDF Form