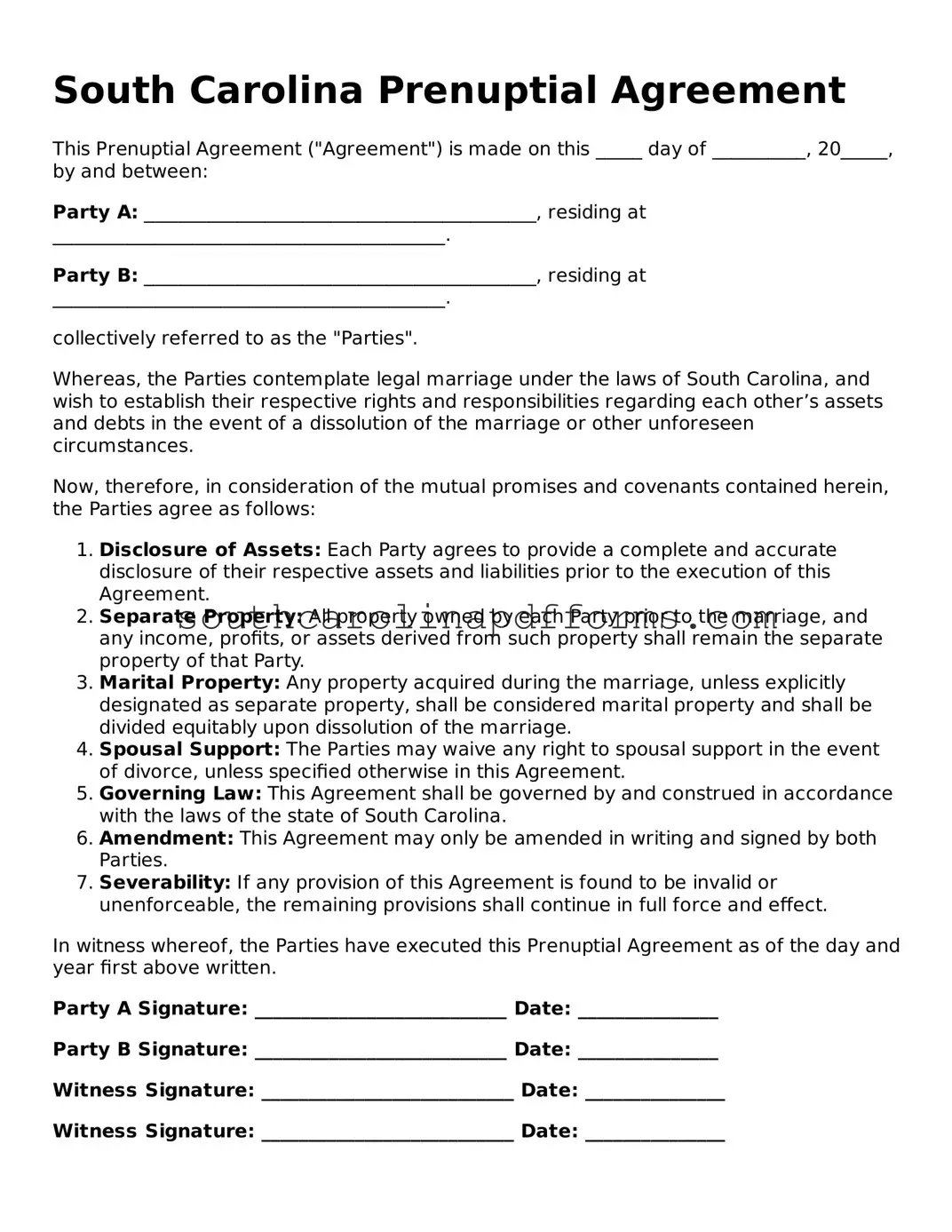

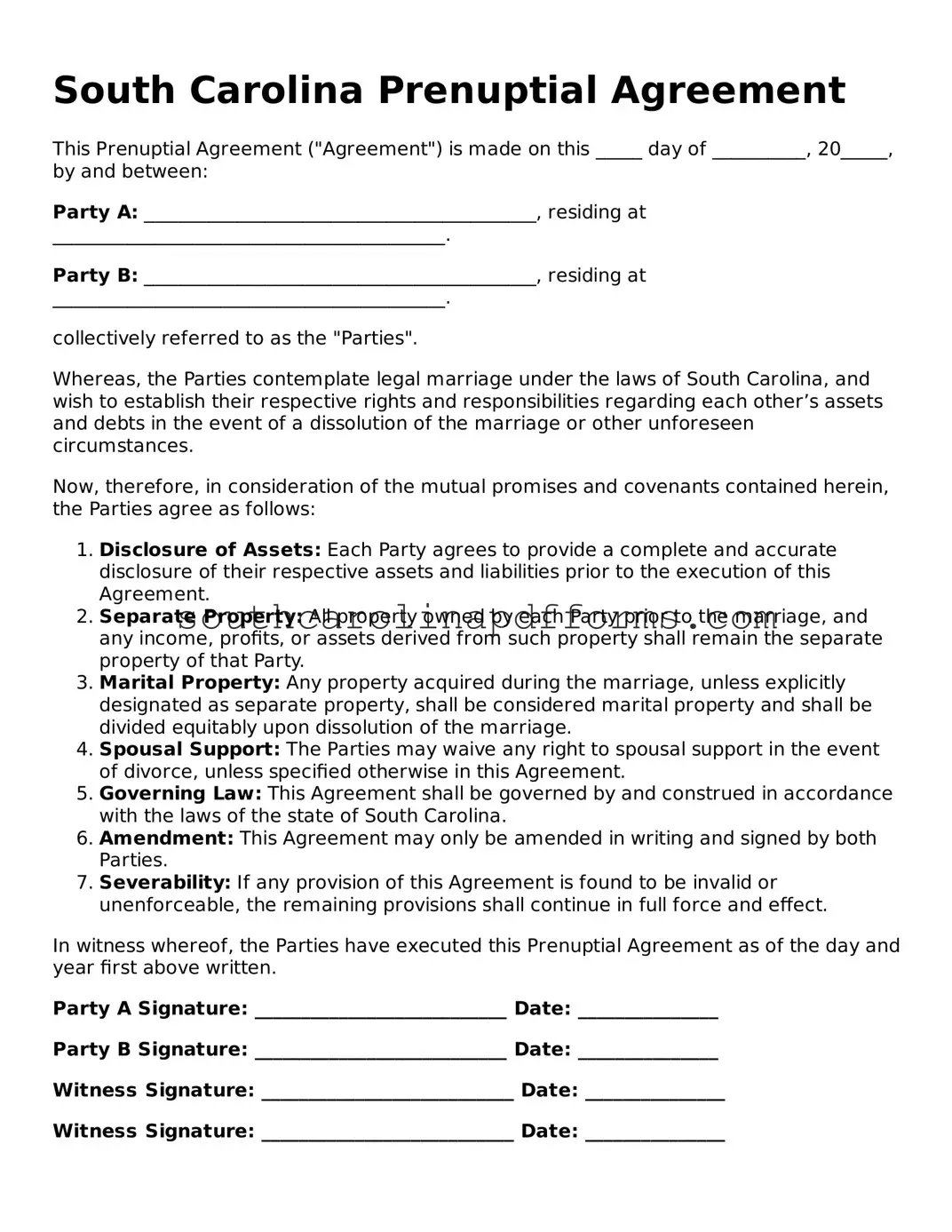

Attorney-Approved South Carolina Prenuptial Agreement Document

A Prenuptial Agreement form is a legal document that outlines the financial and personal rights of each partner before entering into marriage. In South Carolina, this agreement can help couples clarify their expectations and protect their assets. Understanding this form is essential for anyone considering marriage, as it can provide peace of mind and promote open communication.

Access Prenuptial Agreement Here

Attorney-Approved South Carolina Prenuptial Agreement Document

Access Prenuptial Agreement Here

Finish the form and move forward

Edit, save, and finish Prenuptial Agreement online.

Access Prenuptial Agreement Here

or

▼ PDF Form