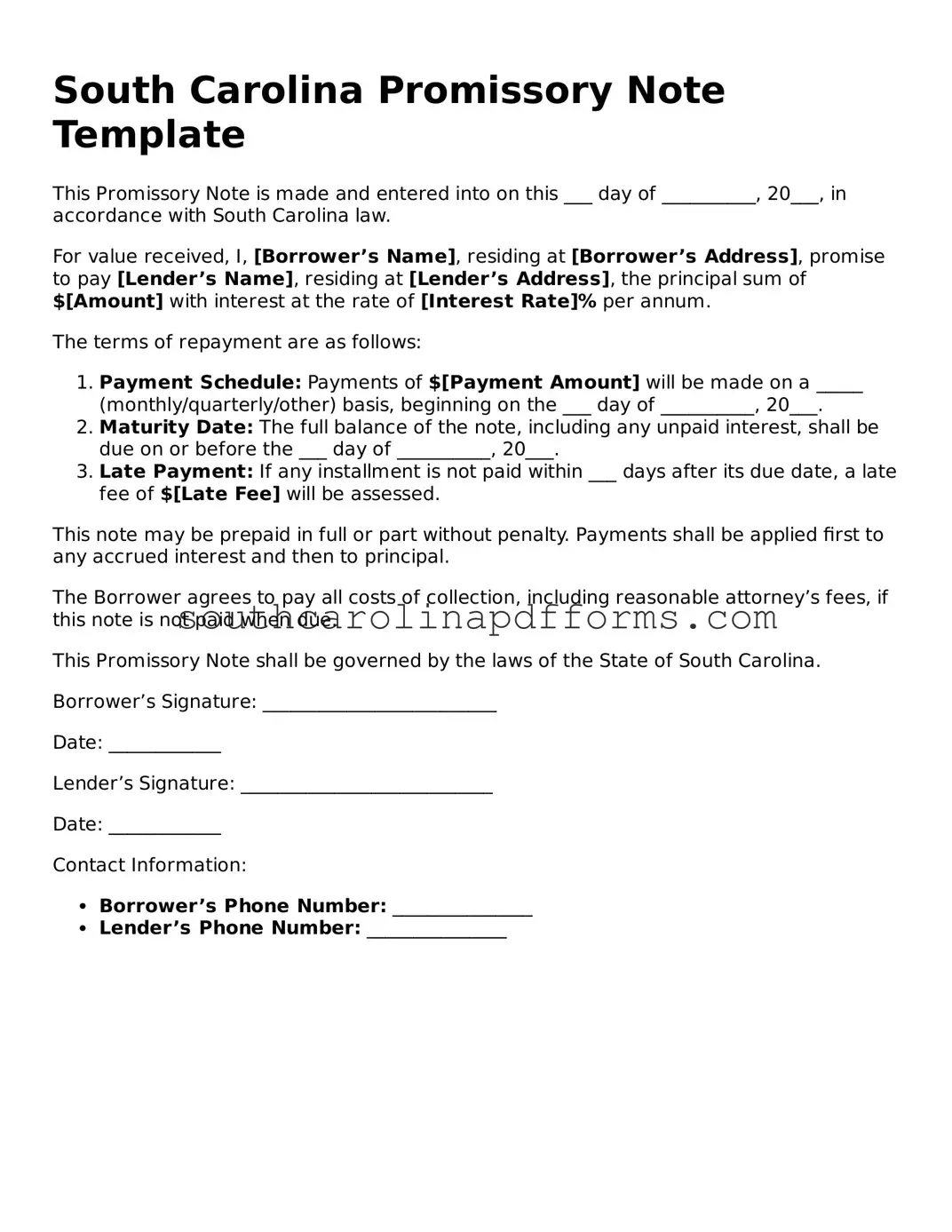

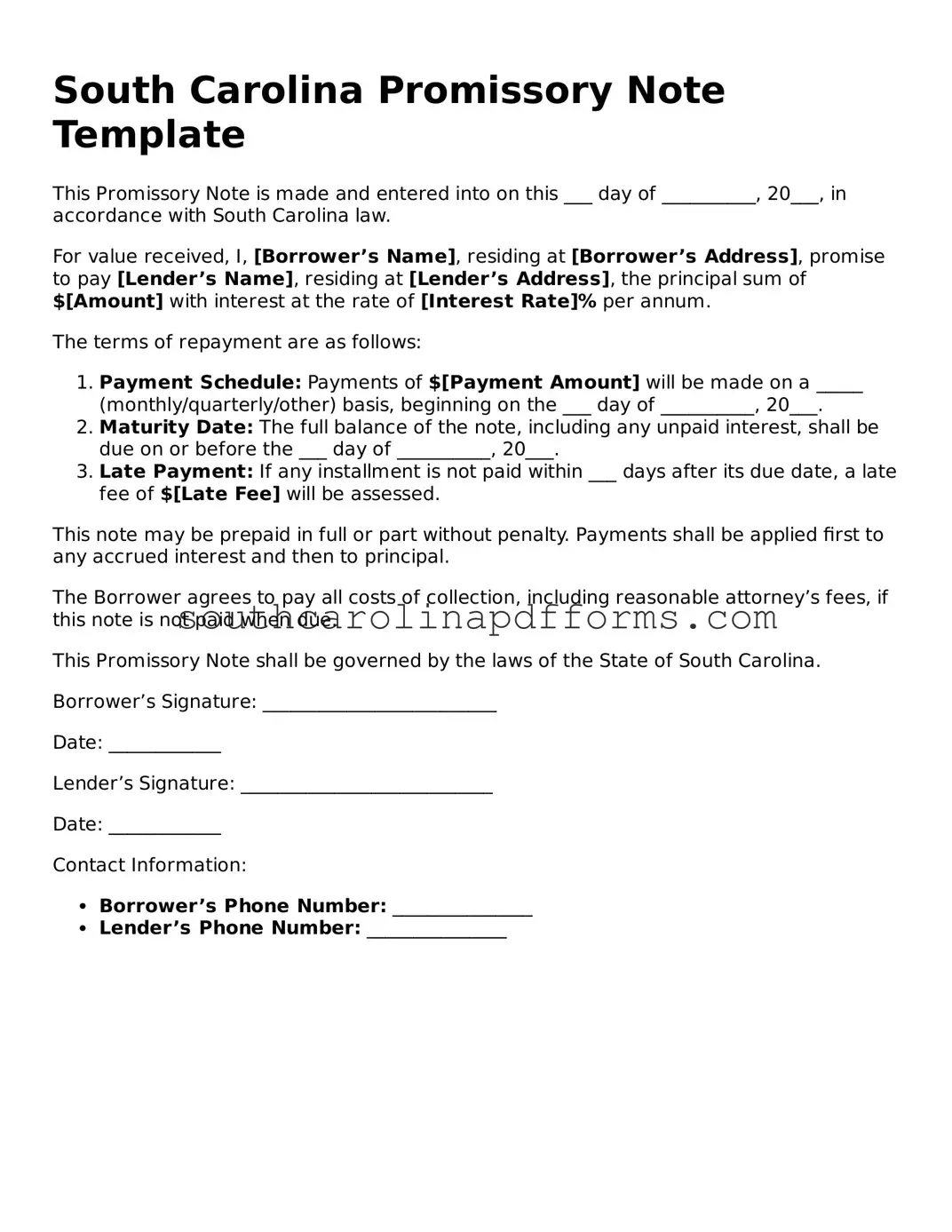

Attorney-Approved South Carolina Promissory Note Document

A South Carolina Promissory Note is a legal document that outlines a borrower's promise to repay a specified amount of money to a lender under agreed-upon terms. This form serves as a crucial tool in financial transactions, providing clarity and protection for both parties involved. Understanding its components and implications is essential for anyone engaging in lending or borrowing in the state.

Access Promissory Note Here

Attorney-Approved South Carolina Promissory Note Document

Access Promissory Note Here

Finish the form and move forward

Edit, save, and finish Promissory Note online.

Access Promissory Note Here

or

▼ PDF Form