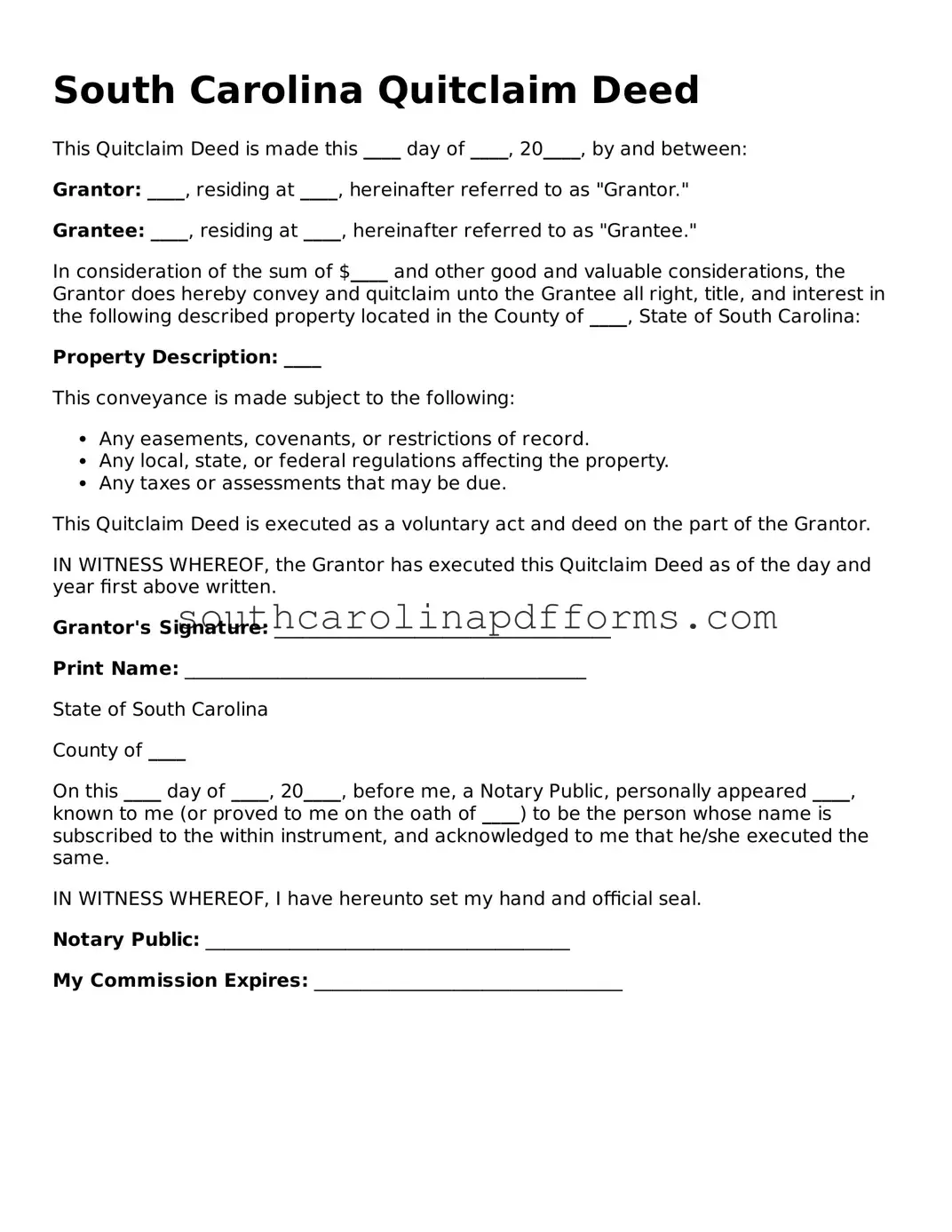

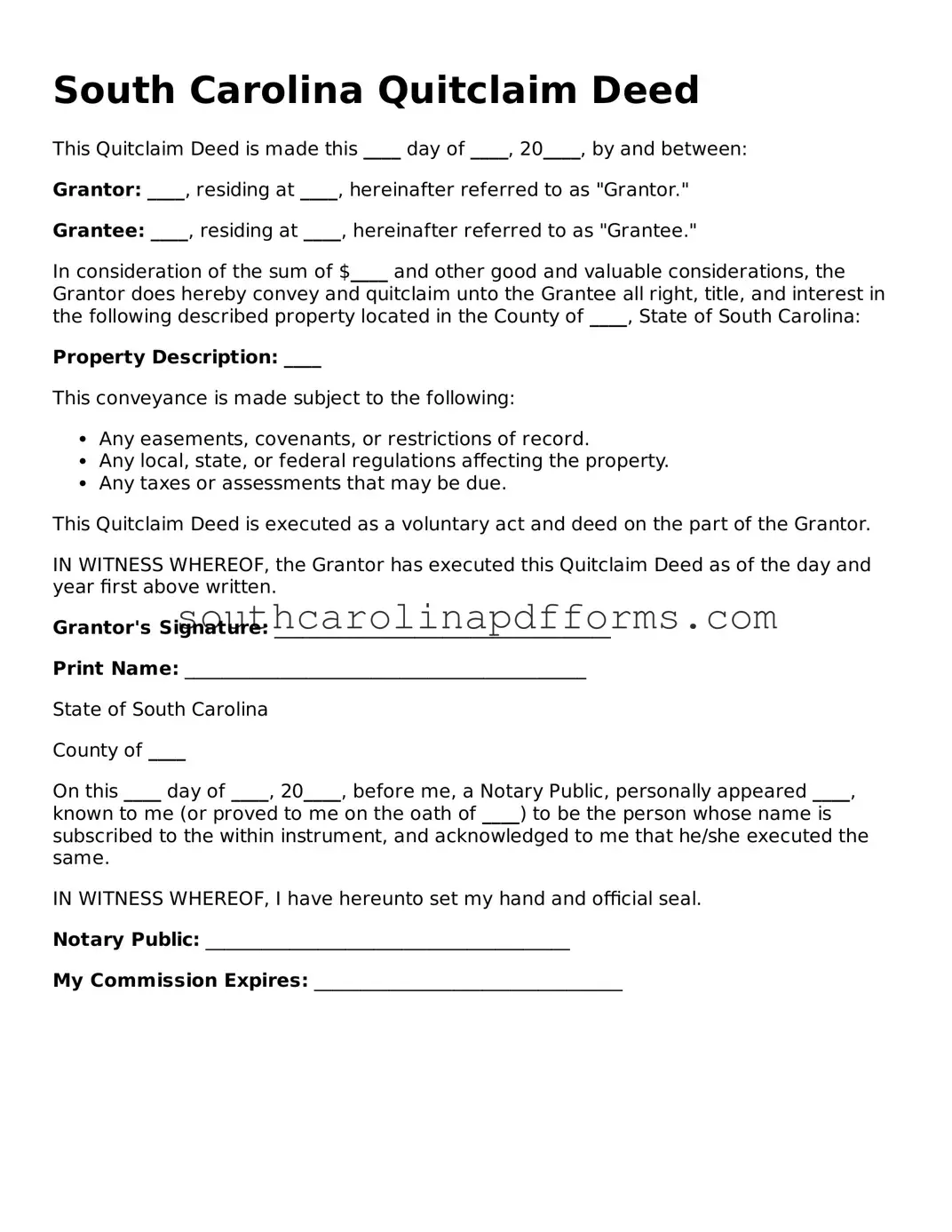

Attorney-Approved South Carolina Quitclaim Deed Document

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties or guarantees regarding the property’s title. In South Carolina, this form serves as a straightforward way to convey interest in property, often utilized in situations such as divorce settlements or transfers between family members. Understanding the specifics of this form is essential for ensuring a smooth and legally sound transfer of property rights.

Access Quitclaim Deed Here

Attorney-Approved South Carolina Quitclaim Deed Document

Access Quitclaim Deed Here

Finish the form and move forward

Edit, save, and finish Quitclaim Deed online.

Access Quitclaim Deed Here

or

▼ PDF Form