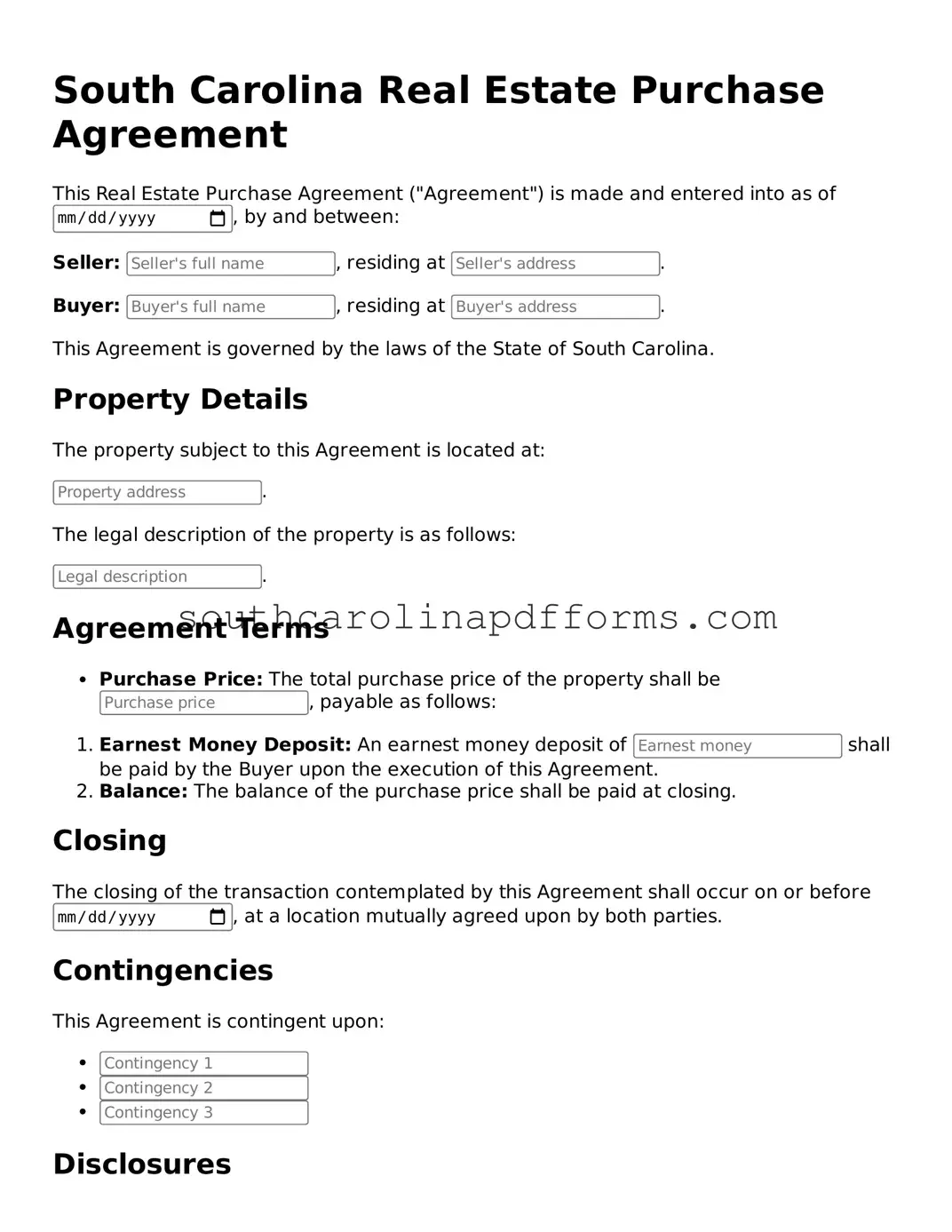

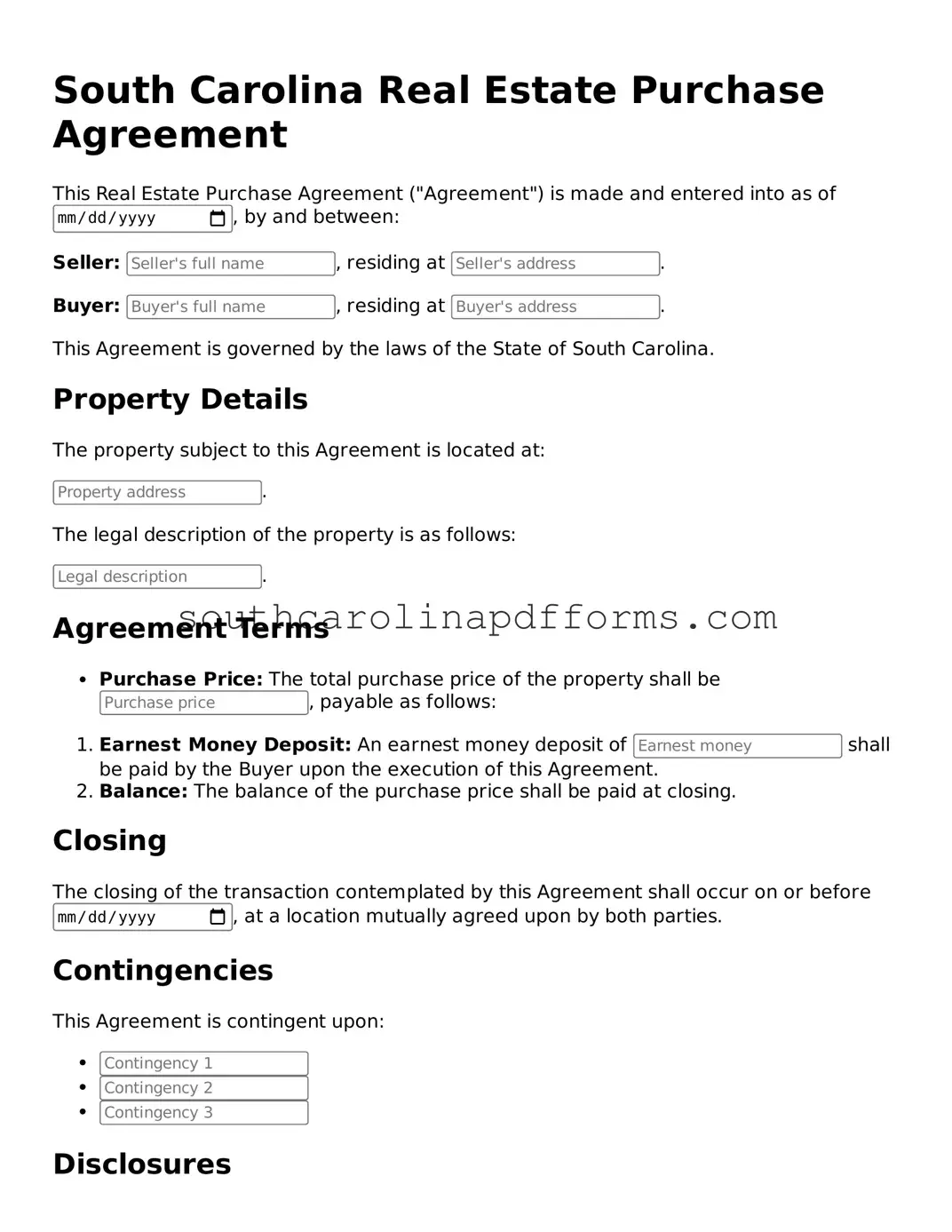

Attorney-Approved South Carolina Real Estate Purchase Agreement Document

The South Carolina Real Estate Purchase Agreement is a legal document that outlines the terms and conditions under which a buyer agrees to purchase property from a seller. This form serves as a crucial step in the real estate transaction process, ensuring that both parties are clear on their obligations and rights. Understanding this agreement can help facilitate a smooth and successful property transfer.

Access Real Estate Purchase Agreement Here

Attorney-Approved South Carolina Real Estate Purchase Agreement Document

Access Real Estate Purchase Agreement Here

Finish the form and move forward

Edit, save, and finish Real Estate Purchase Agreement online.

Access Real Estate Purchase Agreement Here

or

▼ PDF Form