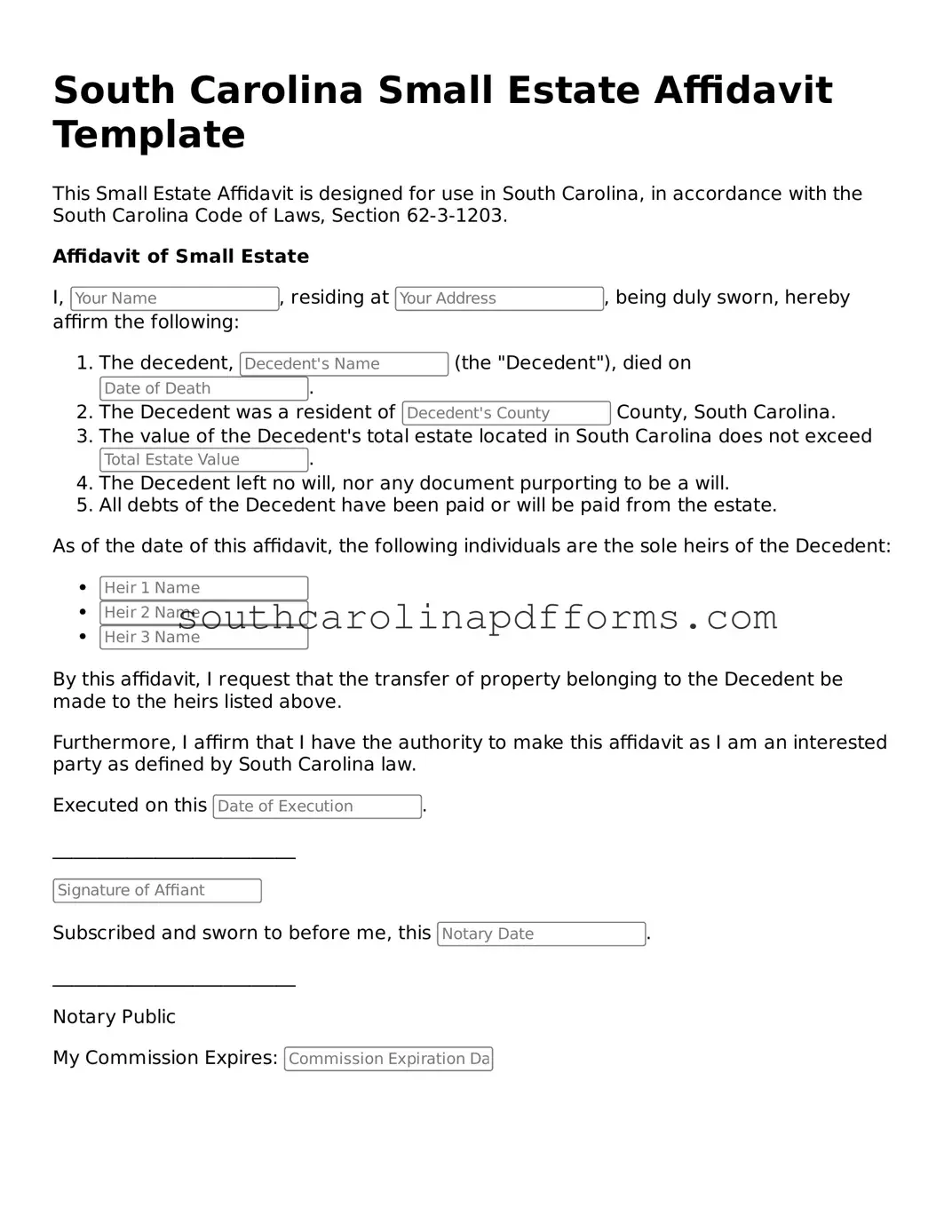

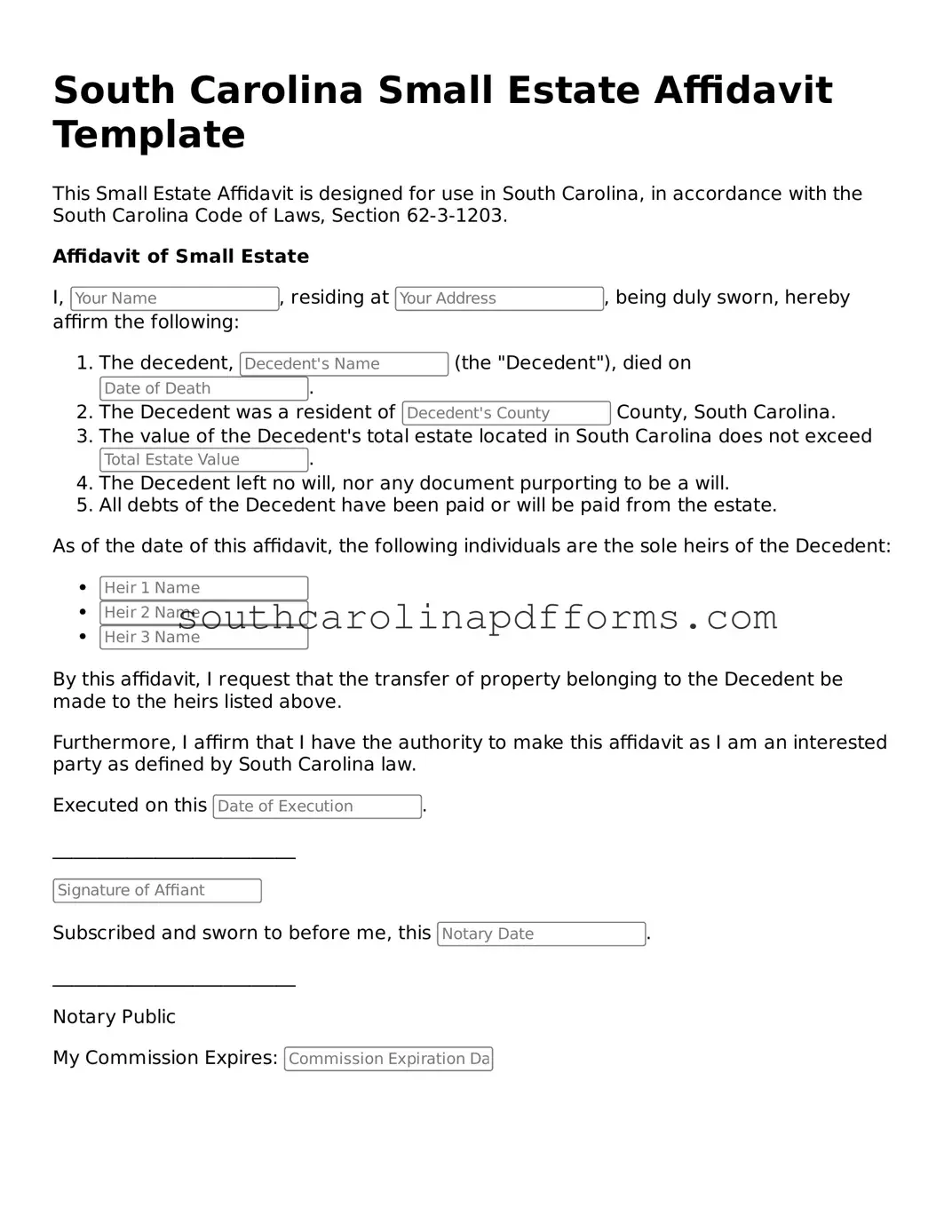

Attorney-Approved South Carolina Small Estate Affidavit Document

The South Carolina Small Estate Affidavit is a legal document that allows individuals to settle the estate of a deceased person without going through the lengthy probate process. This form is particularly useful for estates with a total value below a specified threshold, enabling heirs to claim assets more efficiently. Understanding how to properly use this affidavit can simplify the process of estate administration for families during a challenging time.

Access Small Estate Affidavit Here

Attorney-Approved South Carolina Small Estate Affidavit Document

Access Small Estate Affidavit Here

Finish the form and move forward

Edit, save, and finish Small Estate Affidavit online.

Access Small Estate Affidavit Here

or

▼ PDF Form