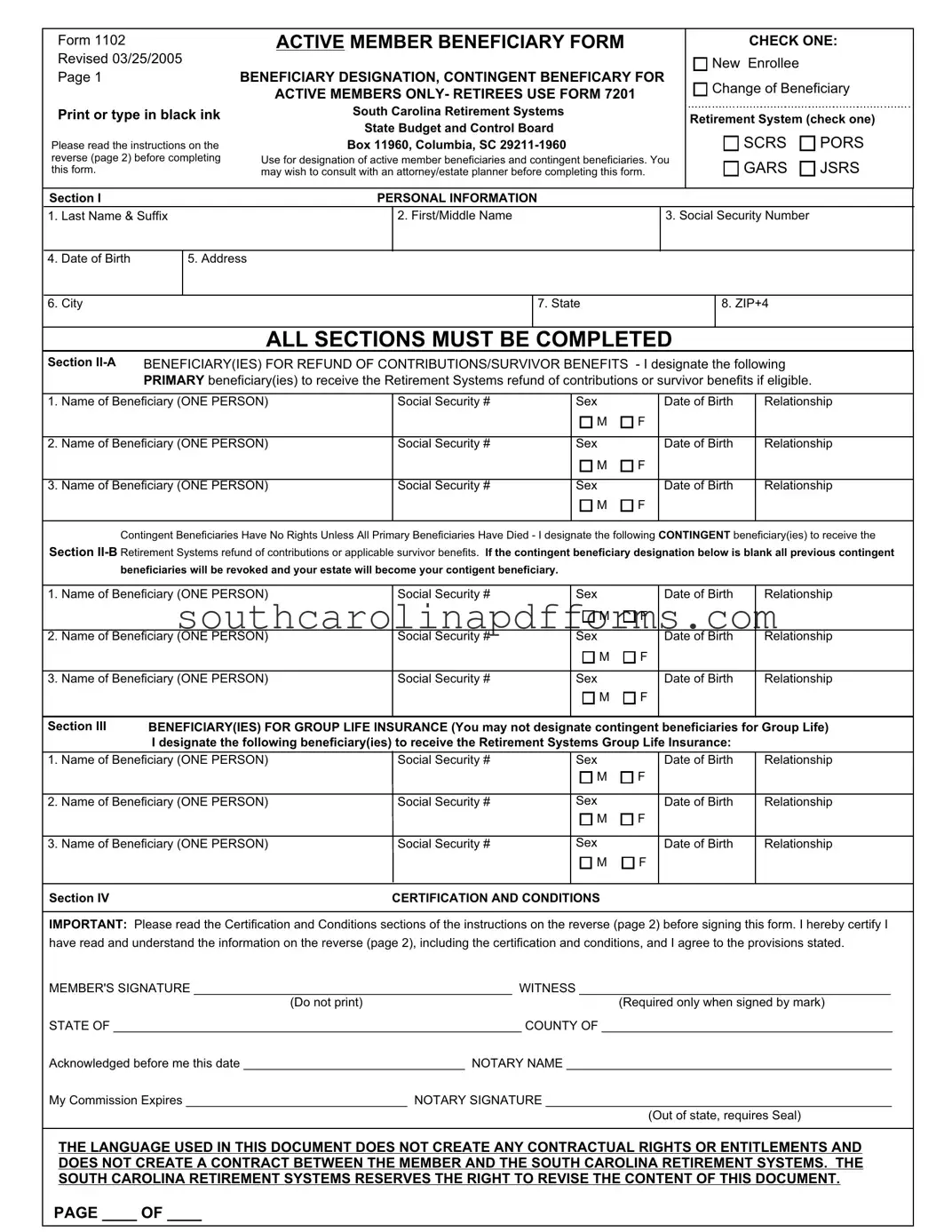

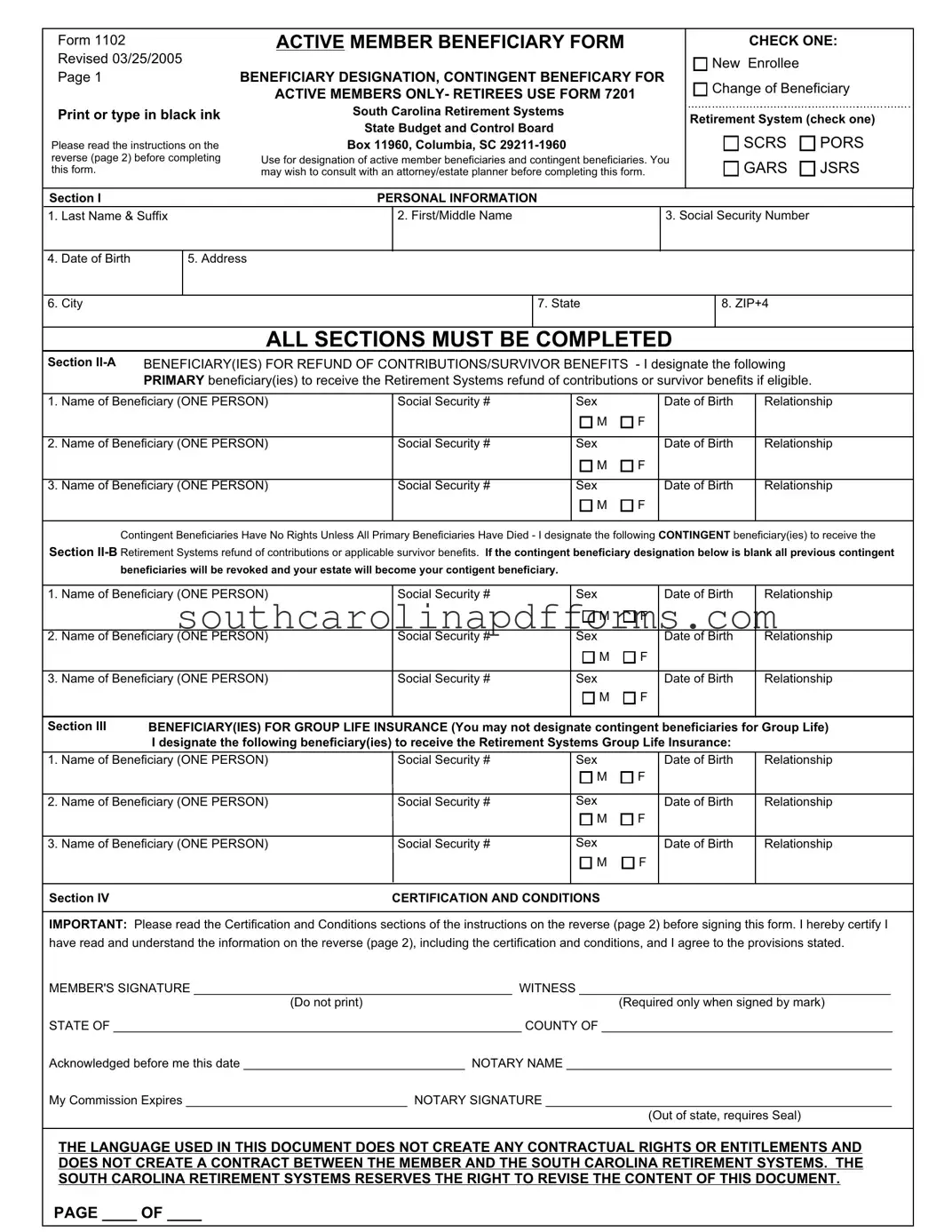

South Carolina 1102 Template

The South Carolina 1102 form is an essential document for active members of the South Carolina Retirement Systems, allowing them to designate beneficiaries for retirement contributions and survivor benefits. This form ensures that, in the event of a member's death, the specified individuals will receive the appropriate benefits. Completing this form accurately is crucial for safeguarding your beneficiaries' rights and ensuring your intentions are honored.

Access South Carolina 1102 Here

South Carolina 1102 Template

Access South Carolina 1102 Here

Finish the form and move forward

Edit, save, and finish South Carolina 1102 online.

Access South Carolina 1102 Here

or

▼ PDF Form