South Carolina 1104 Template

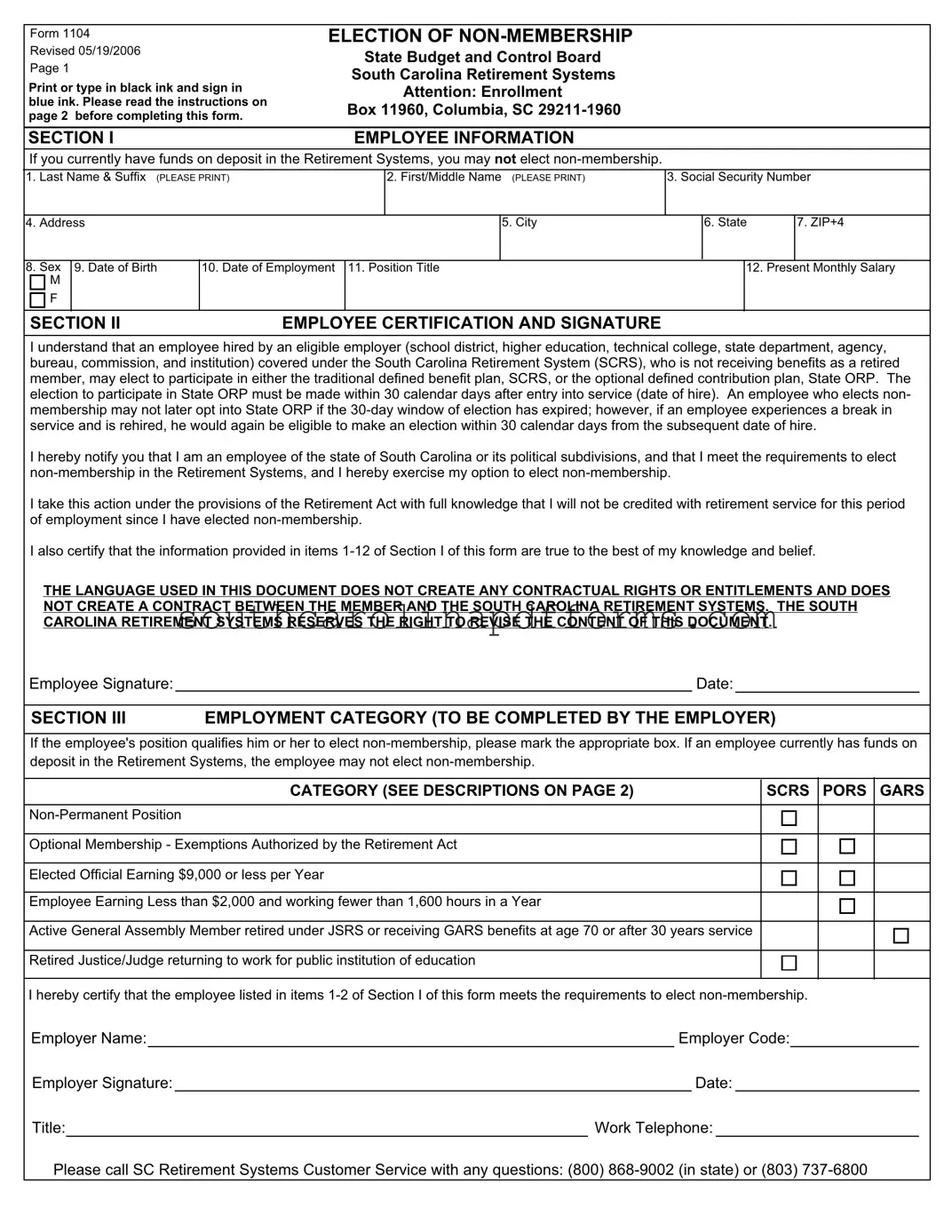

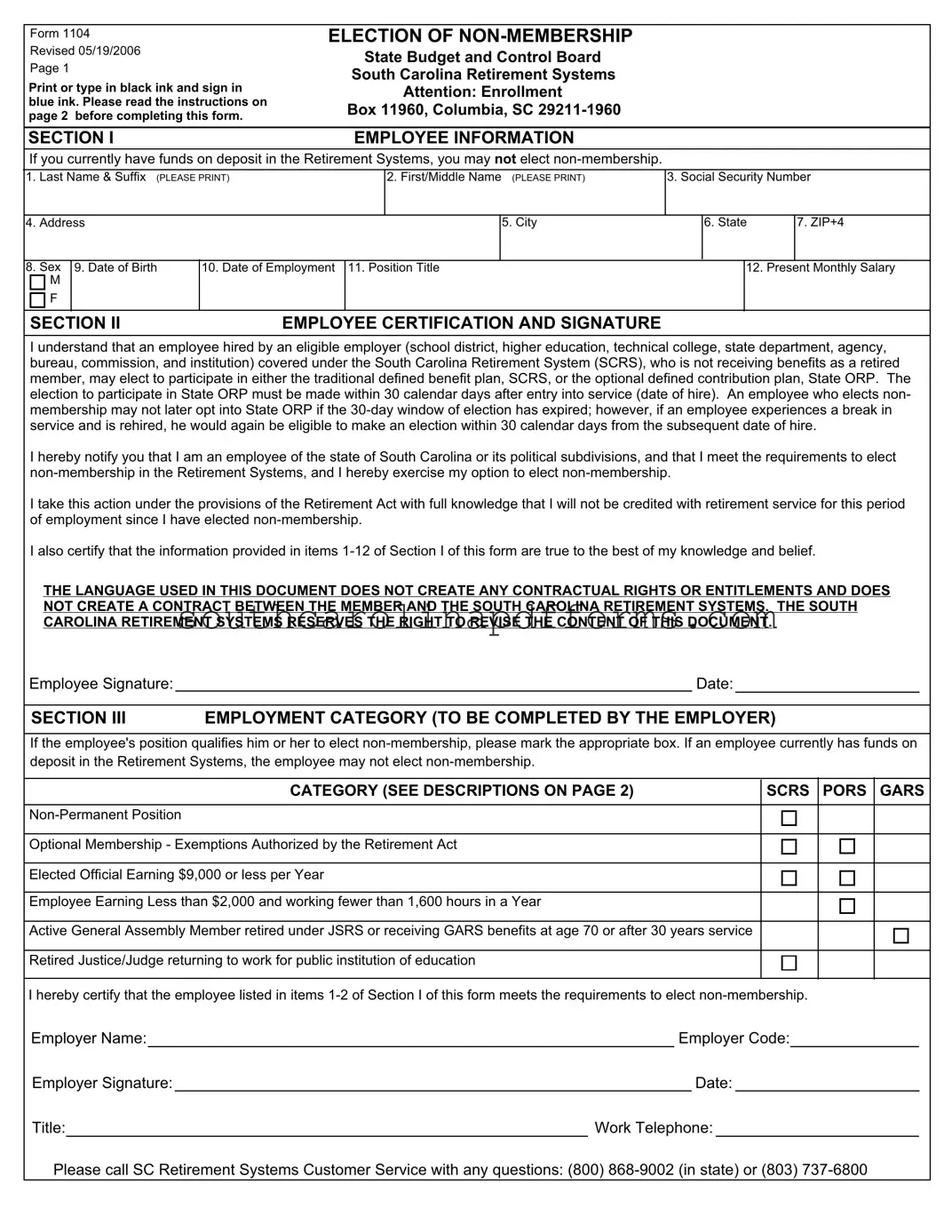

The South Carolina 1104 form is used to elect non-membership in the South Carolina Retirement Systems. This form is applicable to employees hired by eligible employers who do not wish to participate in the traditional defined benefit plan or the optional defined contribution plan. It is important for employees to understand the implications of this election, as it affects their retirement service credit.

Access South Carolina 1104 Here

South Carolina 1104 Template

Access South Carolina 1104 Here

Finish the form and move forward

Edit, save, and finish South Carolina 1104 online.

Access South Carolina 1104 Here

or

▼ PDF Form