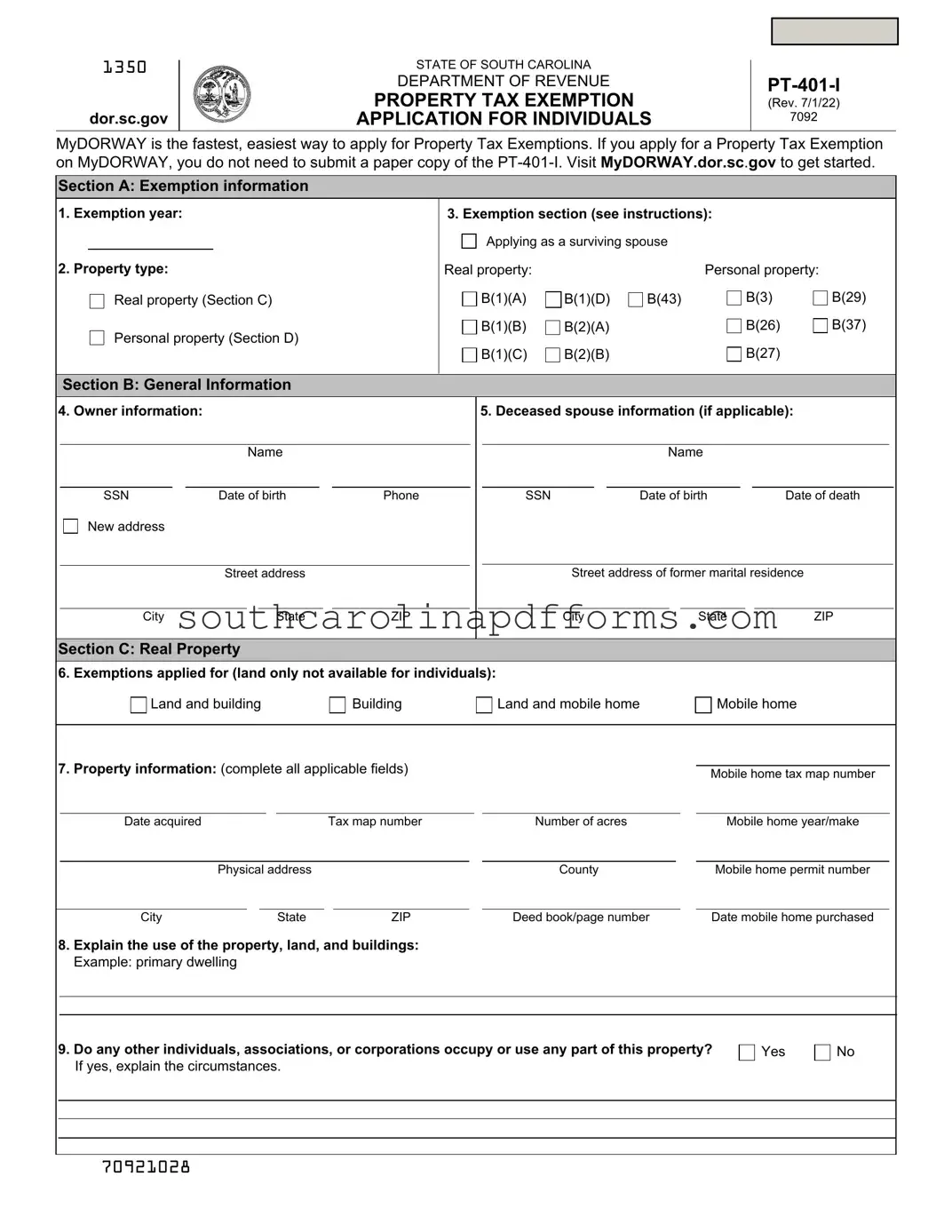

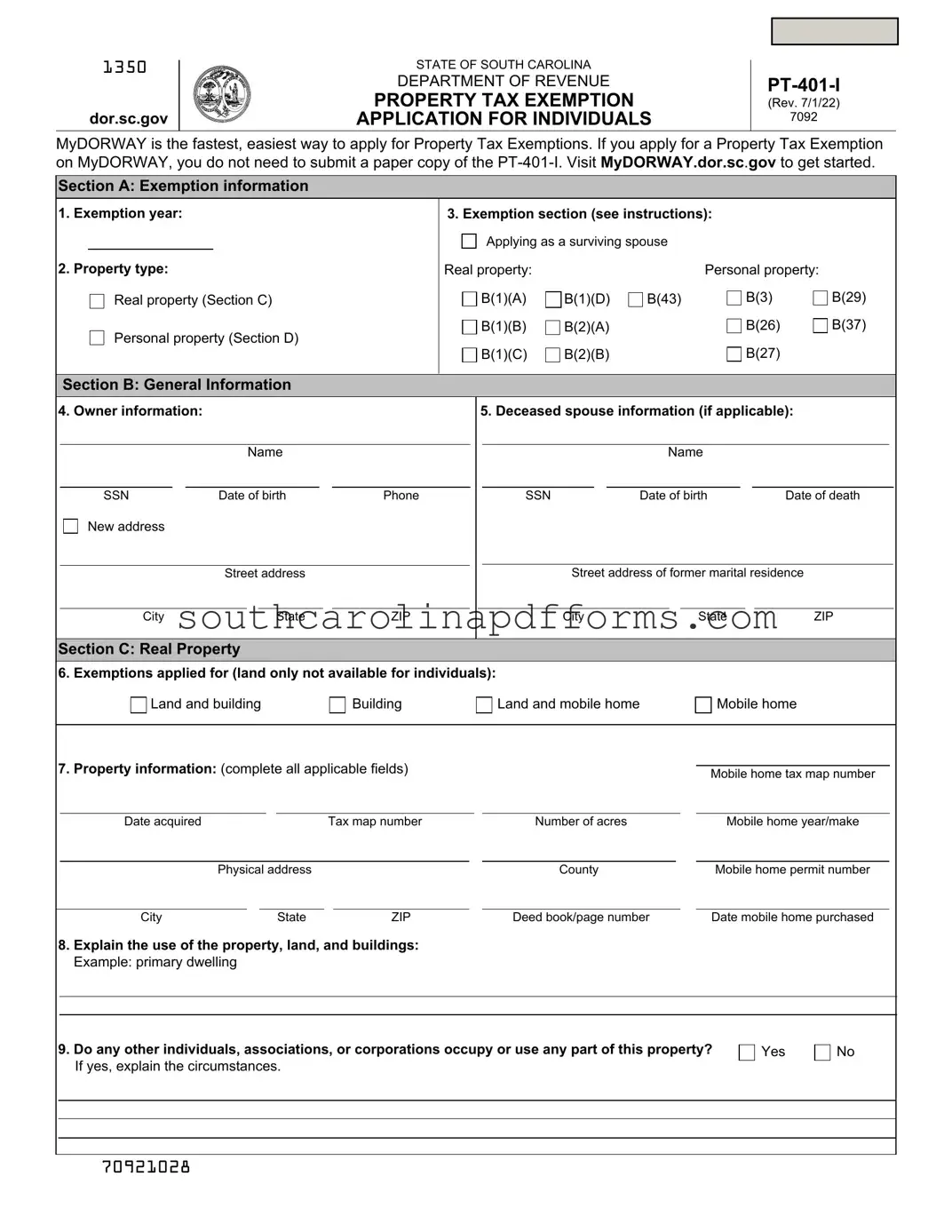

South Carolina Pt 401 Template

The South Carolina PT-401 form is a Tax Exemption Application that allows property owners or their agents to apply for exemptions from property taxes. Completing this form accurately is crucial, as any omissions will result in delays or rejection of the application. Proper submission to the South Carolina Department of Revenue is essential to ensure timely processing.

Access South Carolina Pt 401 Here

South Carolina Pt 401 Template

Access South Carolina Pt 401 Here

Finish the form and move forward

Edit, save, and finish South Carolina Pt 401 online.

Access South Carolina Pt 401 Here

or

▼ PDF Form