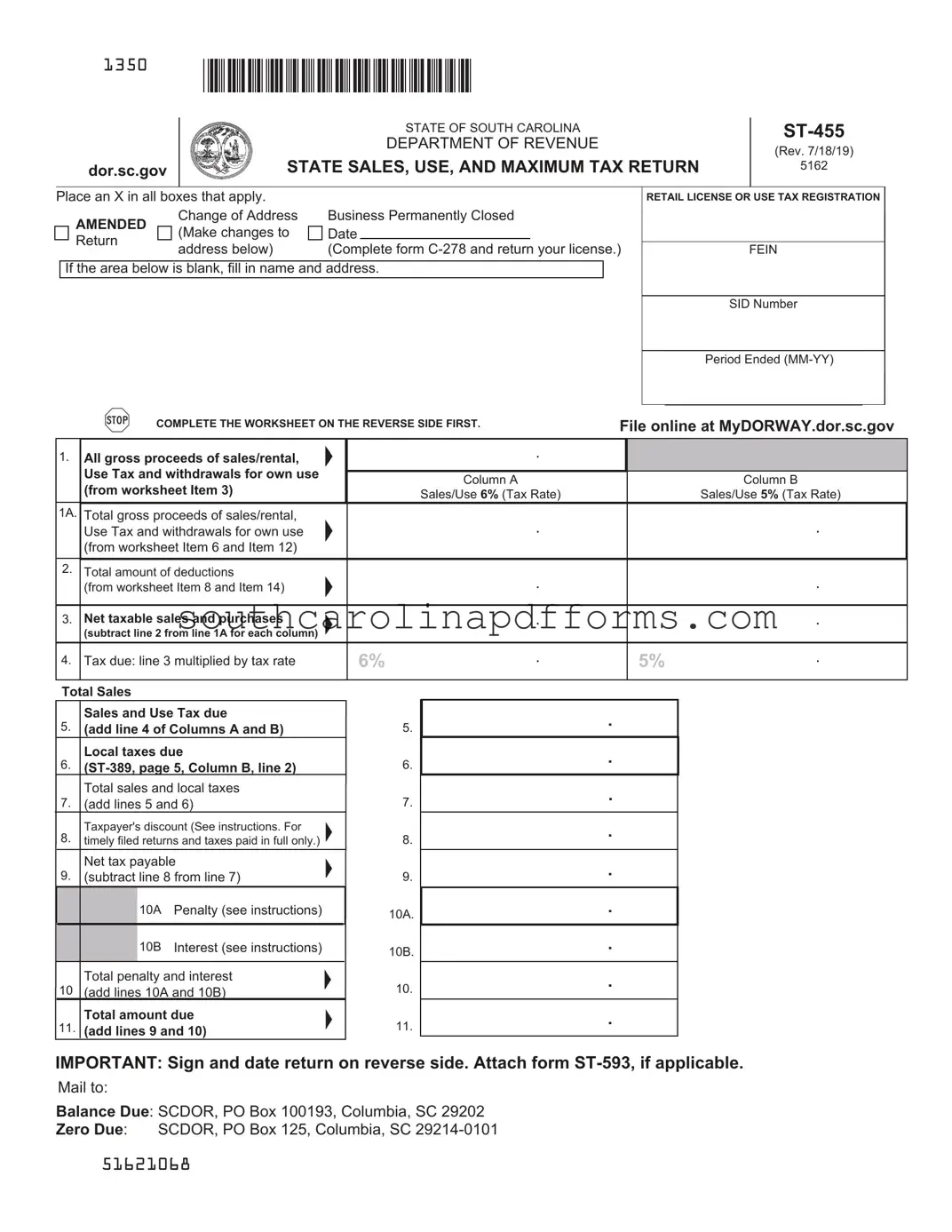

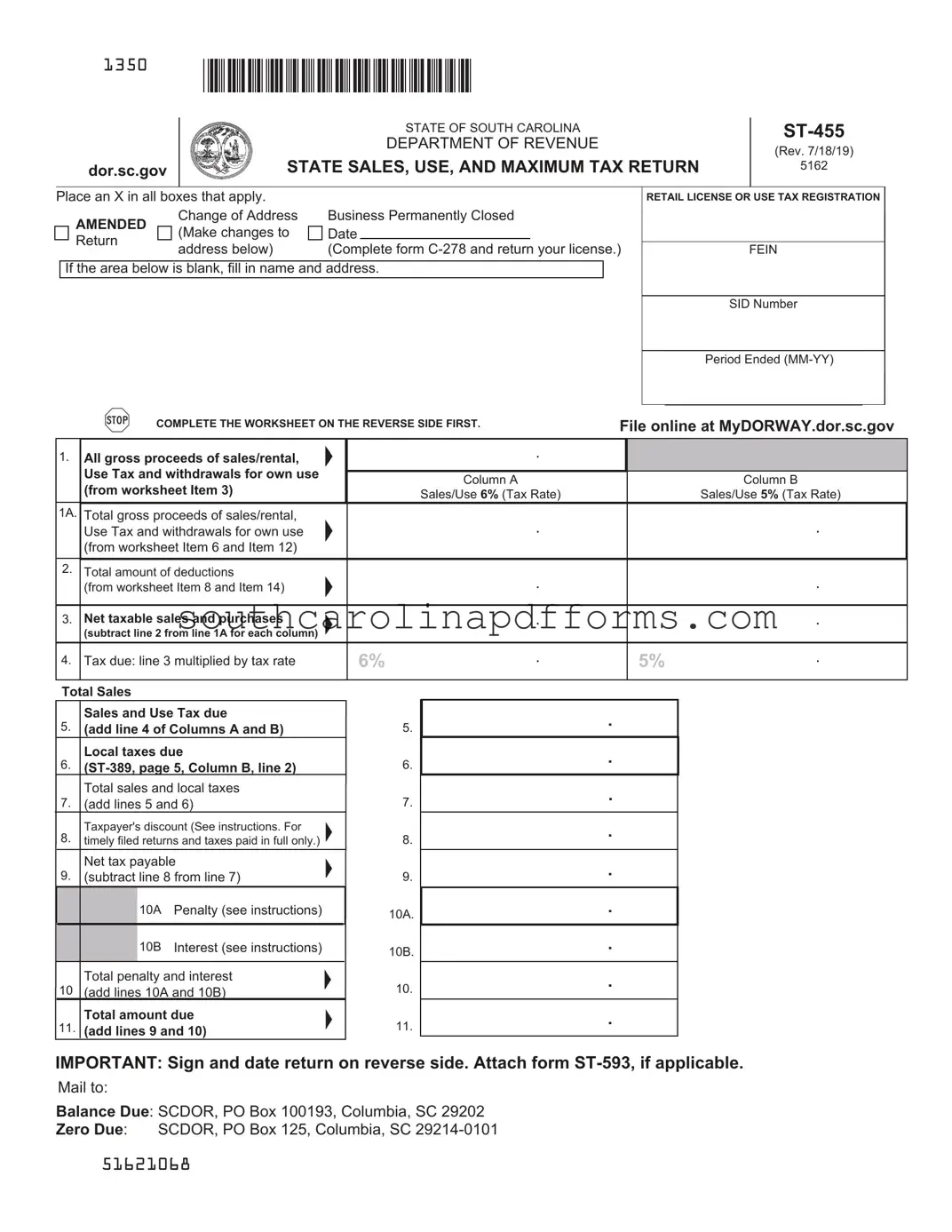

State Of South Carolina St455 Template

The State of South Carolina ST-455 form is a crucial document for businesses operating within the state, serving as the official Sales, Use, and Maximum Tax Return. This form allows businesses to report their taxable sales and calculate the taxes owed to the state. Understanding how to accurately complete the ST-455 is essential for compliance and avoiding potential penalties.

Access State Of South Carolina St455 Here

State Of South Carolina St455 Template

Access State Of South Carolina St455 Here

Finish the form and move forward

Edit, save, and finish State Of South Carolina St455 online.

Access State Of South Carolina St455 Here

or

▼ PDF Form